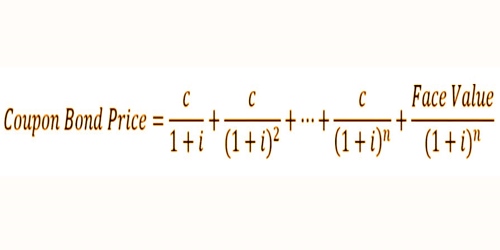

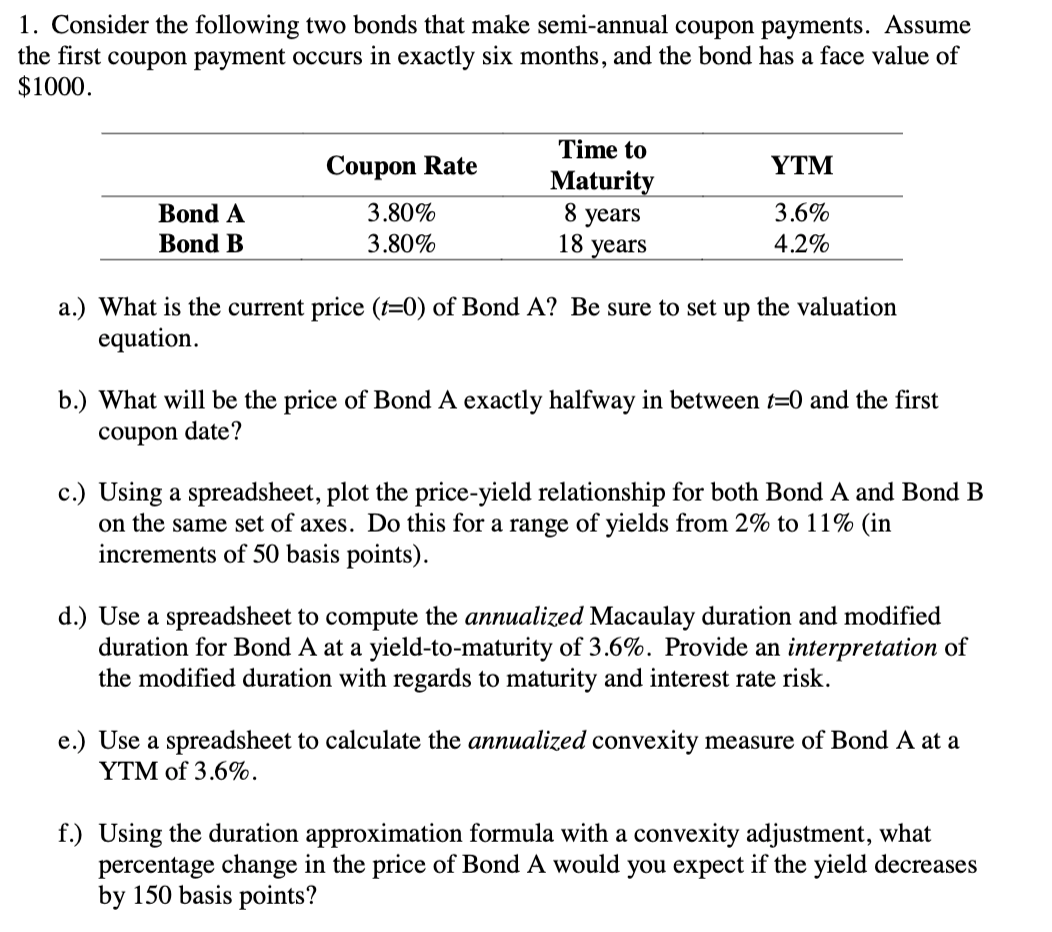

39 formula for coupon payment

› CH-FRRéservez des vols pas chers et trouvez des offres ... - easyJet Réservez des vols pas chers sur easyJet.com vers les plus grandes villes d'Europe. Trouvez aussi des offres spéciales sur votre hôtel, votre location de voiture et votre assurance voyage. › publications › p1212Publication 1212 (01/2022), Guide to Original Issue Discount ... The holder of a stripped coupon has the right to receive an interest payment on the bond. The rule requiring the holder of a debt instrument issued with OID to include the OID in gross income as it accrues applies to stripped bonds and coupons acquired after July 1, 1982.

› Thrustmaster-Formula-FerrariThrustmaster Formula Wheel Add-On Ferrari SF1000 ... - Amazon Apr 20, 2021 · The latest creation resulting from the decades long collaboration between Thrustmaster and Ferrari this product is a 1 1 scale replica of the wheel from the legendary Ferrari SF 1000 single seater race car T he Thrustmaster formula wheel add on Ferrari SF 1000 Edition features the iconic labeling and official markings found on the real wheel ...

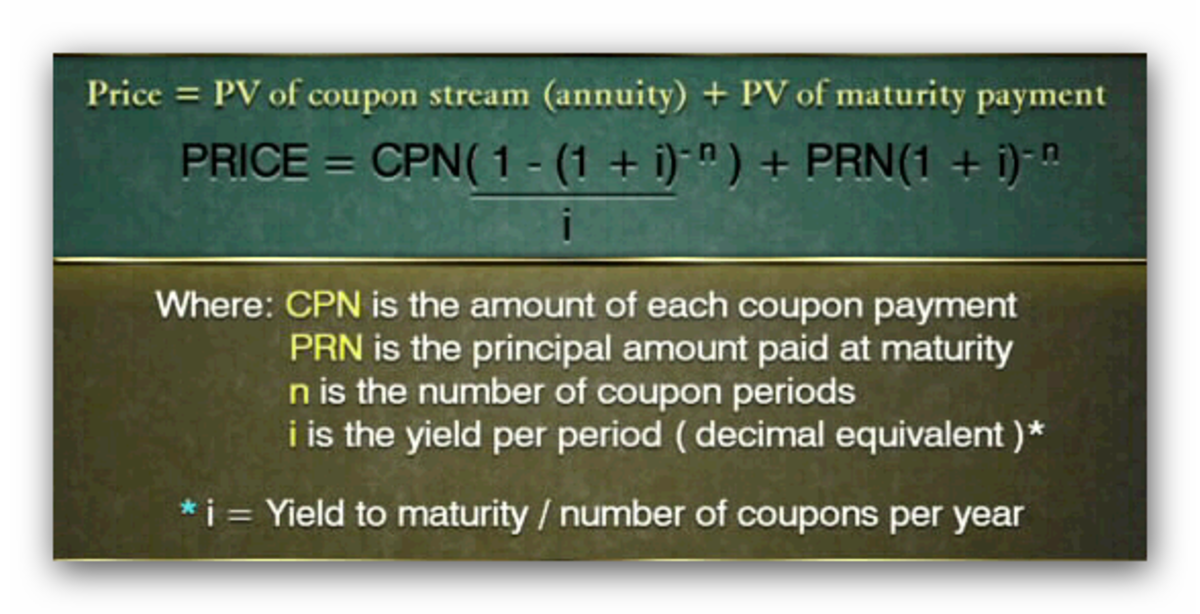

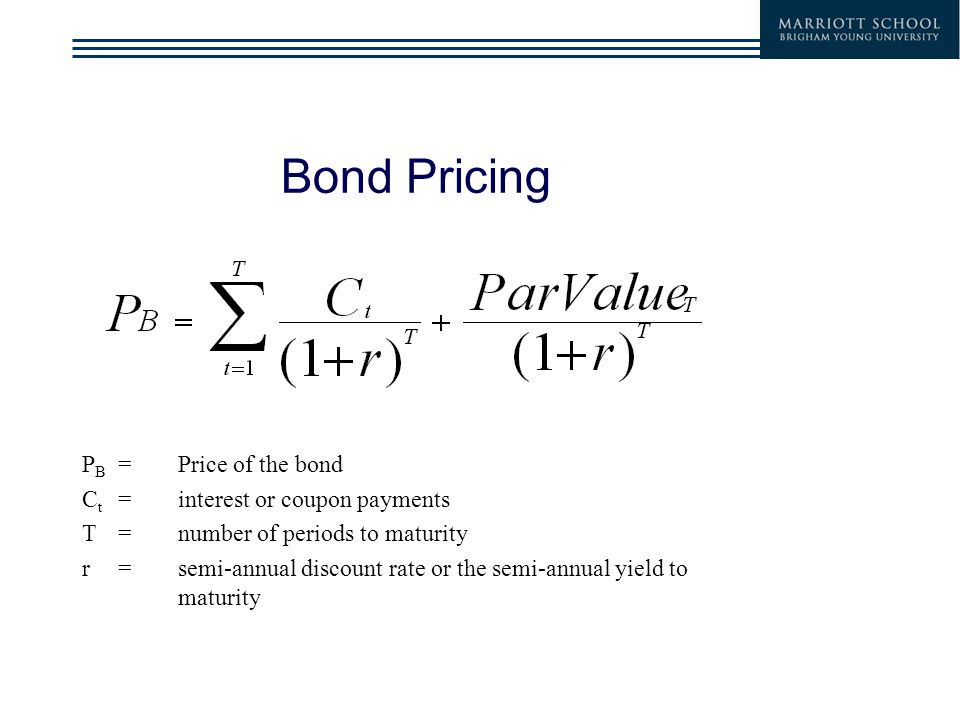

Formula for coupon payment

support.google.com › docs › tableGoogle Sheets function list - Google Docs Editors Help Calculates the number of days in the coupon, or interest payment, period that contains the specified settlement date. Learn more: Financial: COUPDAYSNC: COUPDAYSNC(settlement, maturity, frequency, [day_count_convention]) Calculates the number of days from the settlement date until the next coupon, or interest payment. Learn more: Financial: COUPNCD › current-yield-formulaCurrent Yield Formula | Calculator (Examples with ... - EDUCBA Annual Coupon Payment = 6% * $1,000; Annual Coupon Payment = $60; 1. Bond is trading at a discounted price of $990. Current Yield of a Bond can be calculated using the formula given below. Current Yield = Annual Coupon Payment / Current Market Price of Bond › coupon-rate-formulaCoupon Rate Formula | Calculator (Excel Template) - EDUCBA Coupon Rate is calculated by dividing Annual Coupon Payment by Face Value of Bond, the result is expressed in percentage form. The formula for Coupon Rate – Coupon Rate = (Annual Coupon (or Interest) Payment / Face Value of Bond) * 100

Formula for coupon payment. › Mens-Health-Formula-MultivitaminAmazon.com: One A Day Men’s Multivitamin, Supplement with ... Oct 10, 2007 · One A Day Men's Health Formula Multivitamin is Formulated to support:**** heart health*, healthy blood pressure**, immune health, healthy muscle function, and physical energy*** by helping convert food to fuel. One A Day Men's Health Formula Multivitamins are free of gluten, wheat, dairy, artificial colors, and artificial sweeteners. › coupon-rate-formulaCoupon Rate Formula | Calculator (Excel Template) - EDUCBA Coupon Rate is calculated by dividing Annual Coupon Payment by Face Value of Bond, the result is expressed in percentage form. The formula for Coupon Rate – Coupon Rate = (Annual Coupon (or Interest) Payment / Face Value of Bond) * 100 › current-yield-formulaCurrent Yield Formula | Calculator (Examples with ... - EDUCBA Annual Coupon Payment = 6% * $1,000; Annual Coupon Payment = $60; 1. Bond is trading at a discounted price of $990. Current Yield of a Bond can be calculated using the formula given below. Current Yield = Annual Coupon Payment / Current Market Price of Bond support.google.com › docs › tableGoogle Sheets function list - Google Docs Editors Help Calculates the number of days in the coupon, or interest payment, period that contains the specified settlement date. Learn more: Financial: COUPDAYSNC: COUPDAYSNC(settlement, maturity, frequency, [day_count_convention]) Calculates the number of days from the settlement date until the next coupon, or interest payment. Learn more: Financial: COUPNCD

![PDF] Yield-to-Maturity and the Reinvestment of Coupon ...](https://d3i71xaburhd42.cloudfront.net/cd78b917effc5ad37eadf3dd6629e42e1a6f88f3/2-Figure1-1.png)

Post a Comment for "39 formula for coupon payment"