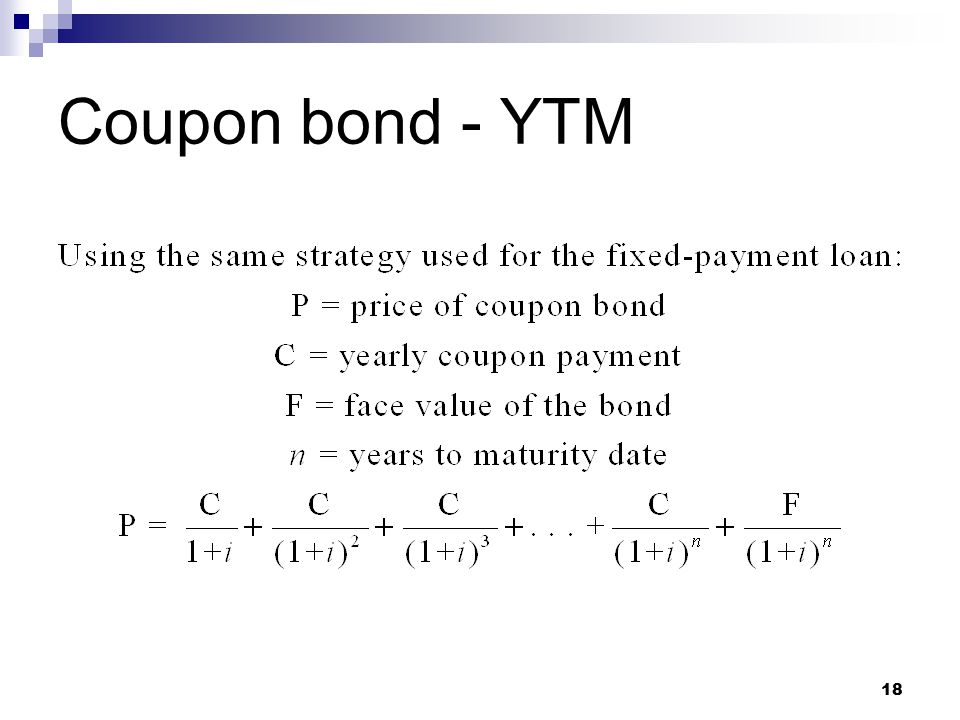

38 ytm for coupon bond

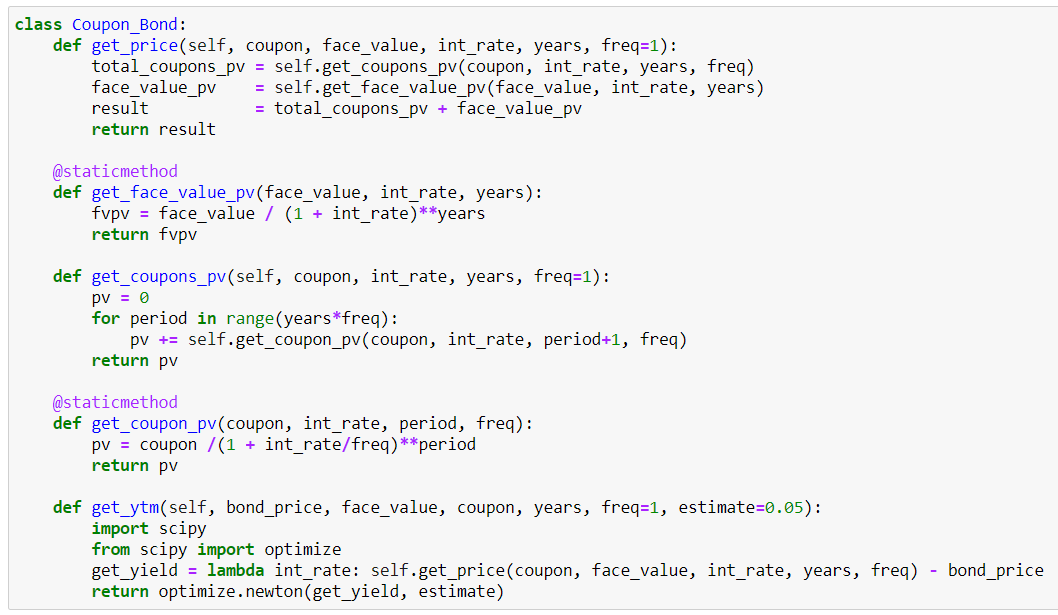

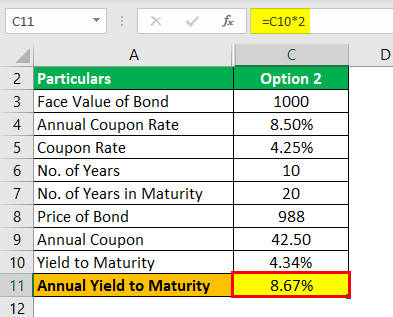

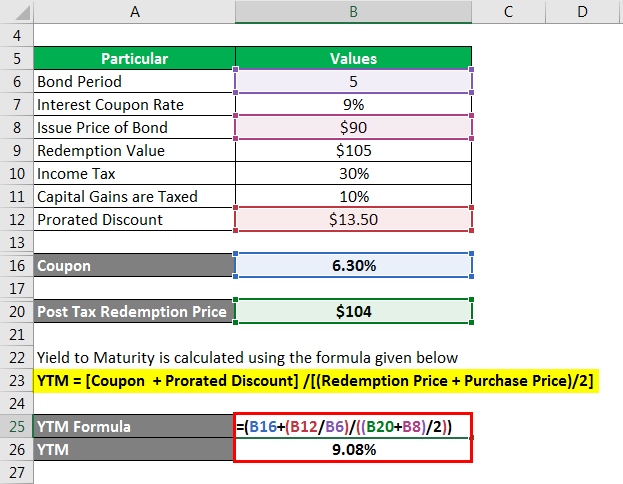

Callable Bonds (Definition, Example) | How it Works? YTM formula = [(Coupon) + {(Maturity Value – Price paid for bond)/(no of years)}] / {(maturity value + price paid for bond)/2} Let us take an example to understand this a better way Face value/maturity value of a bond is Rs 1000, No of years of maturity is 10 years, the interest rate is 10%. Bond Pricer & YTM Calculator – Calculate Bond Prices and ... The simplest way to calculate a bond yield is to divide its coupon payment by the face value of the bond. This is called the coupon rate or coupon yield. Coupon Rate = Annual Interest Payment / Bond Face Value However, if the annual coupon payment is divided by the bond's current market price, the investor can calculate the current yield of the ...

Bond Formula | How to Calculate a Bond | Examples with Excel ... Let us take the example of another bond issue by SDF Inc. that will pay semi-annual coupons. The bonds have a face value of $1,000 and a coupon rate of 6% with maturity tenure of 10 years. Calculate the price of each coupon bond issued by SDF Inc. if the YTM based on current market trends is 4%.

Ytm for coupon bond

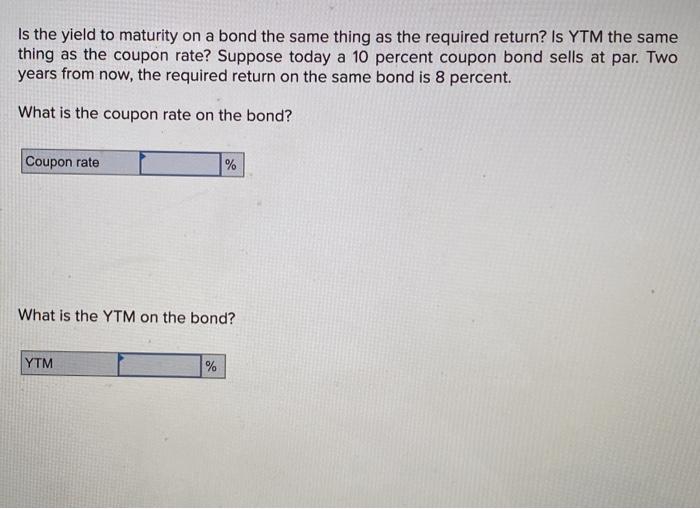

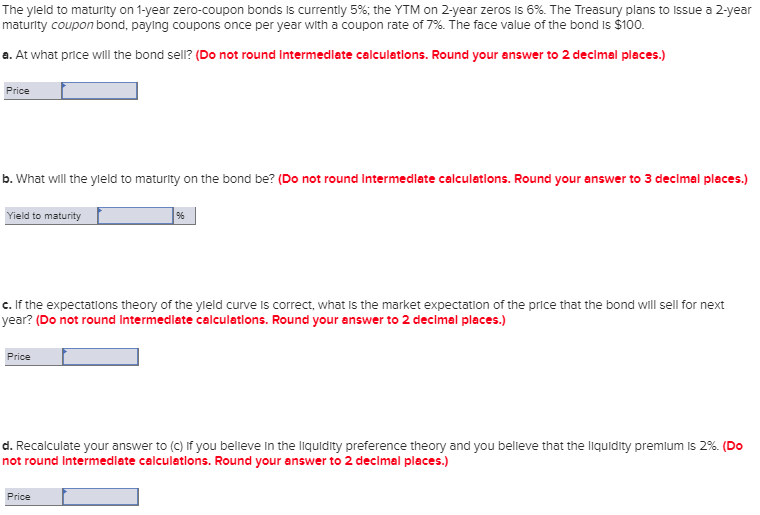

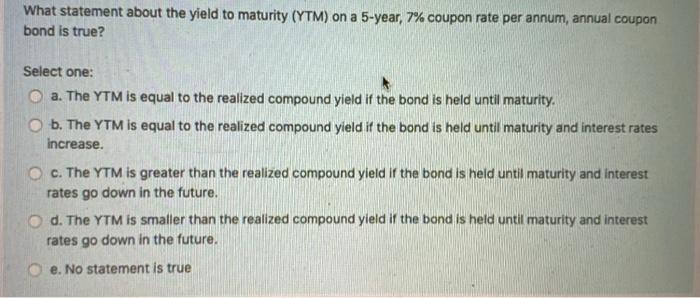

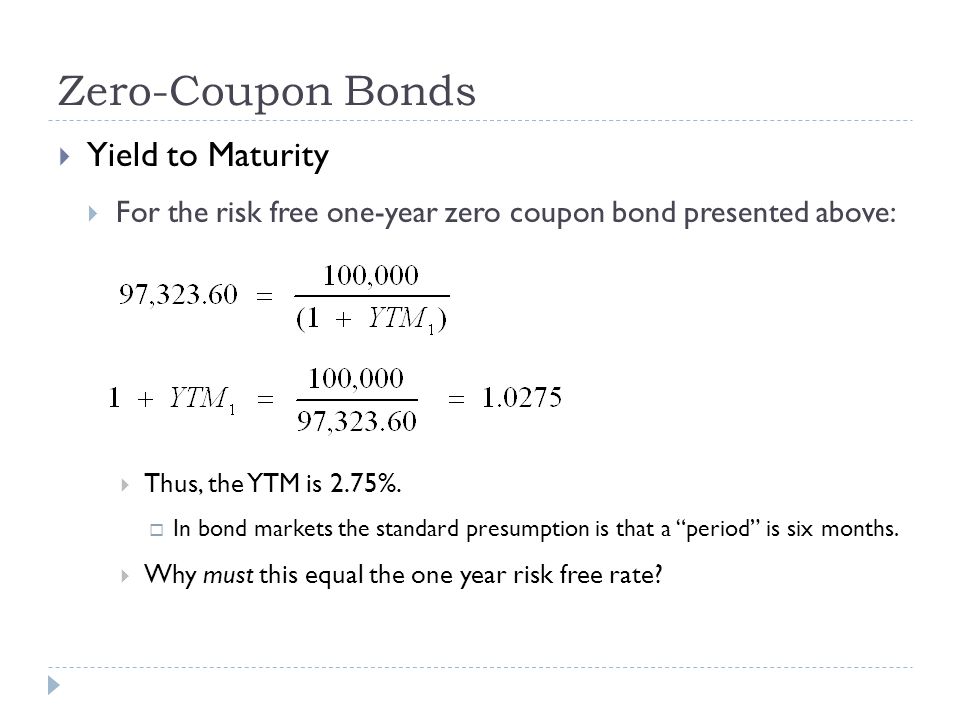

Yield to Maturity – YTM vs. Spot Rate. What's the Difference? Jan 23, 2022 · The spot interest rate for a zero-coupon bond is the same as the YTM for a zero-coupon bond. Yield to Maturity (YTM) Investors will consider the yield to maturity as they compare one bond offering ... Yield to Maturity (YTM): What It Is, Why It Matters, Formula May 31, 2022 · Yield to maturity (YTM) is the total return anticipated on a bond if the bond is held until it matures. Yield to maturity is considered a long-term bond yield , but is expressed as an annual rate ... Bond Basics: Issue Size and Date, Maturity Value, Coupon May 28, 2022 · Coupon and Yield to Maturity . The coupon rate is the periodic interest payment that the issuer makes during the life of the bond. For instance, a bond with a $10,000 maturity value might offer a coupon of 5%. Then, you can expect to receive $500 each year until the bond matures.

Ytm for coupon bond. Yield to Maturity vs. Coupon Rate: What's the Difference? May 20, 2022 · The yield to maturity (YTM) is the percentage rate of return for a bond assuming that the investor holds the asset until its maturity date. It is the sum of all of its remaining coupon payments. A ... Bond Basics: Issue Size and Date, Maturity Value, Coupon May 28, 2022 · Coupon and Yield to Maturity . The coupon rate is the periodic interest payment that the issuer makes during the life of the bond. For instance, a bond with a $10,000 maturity value might offer a coupon of 5%. Then, you can expect to receive $500 each year until the bond matures. Yield to Maturity (YTM): What It Is, Why It Matters, Formula May 31, 2022 · Yield to maturity (YTM) is the total return anticipated on a bond if the bond is held until it matures. Yield to maturity is considered a long-term bond yield , but is expressed as an annual rate ... Yield to Maturity – YTM vs. Spot Rate. What's the Difference? Jan 23, 2022 · The spot interest rate for a zero-coupon bond is the same as the YTM for a zero-coupon bond. Yield to Maturity (YTM) Investors will consider the yield to maturity as they compare one bond offering ...

Post a Comment for "38 ytm for coupon bond"