42 ytm for zero coupon bond

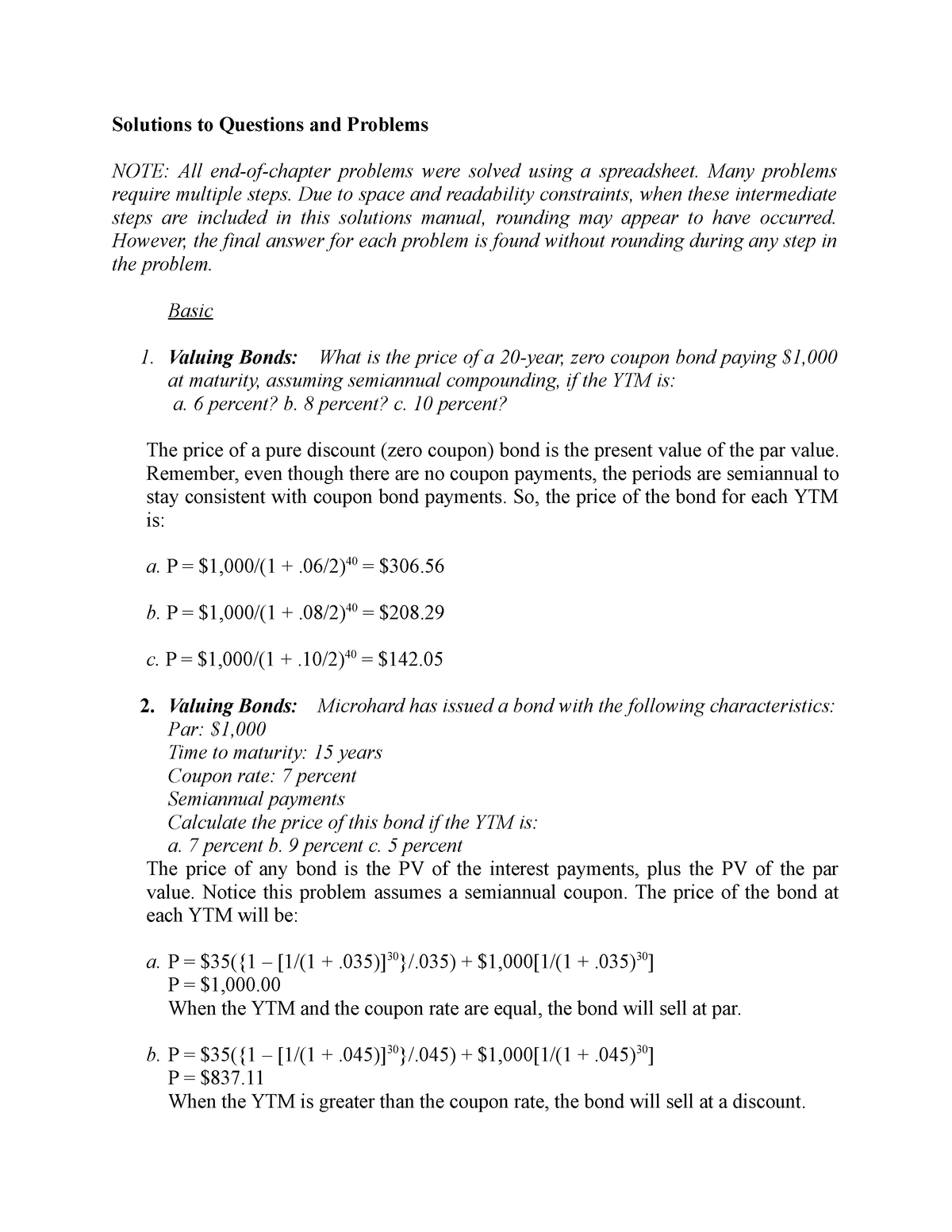

iShares® iBonds® Dec 2029 Term Corporate ETF | IBDU - BlackRock The iShares® iBonds® Dec 2029 Term Corporate ETF (the "Fund") seeks to track the investment results of an index composed of U.S. dollar-denominated, investment-grade corporate bonds maturing in 2029.This Fund is covered by U.S. Patent Nos. 8,438,100 and 8,655,770. Total Return Bond - Institutional Class - Portfolio | Guggenheim ... Yield to maturity is the internal rate of return earned by an investor who buys the bond today at the market price, assuming that the bond will be held until maturity, and that all coupon and principal payments will be made on schedule. ... Average Price excludes zero coupon, interest only and principal only bonds, preferred securities not ...

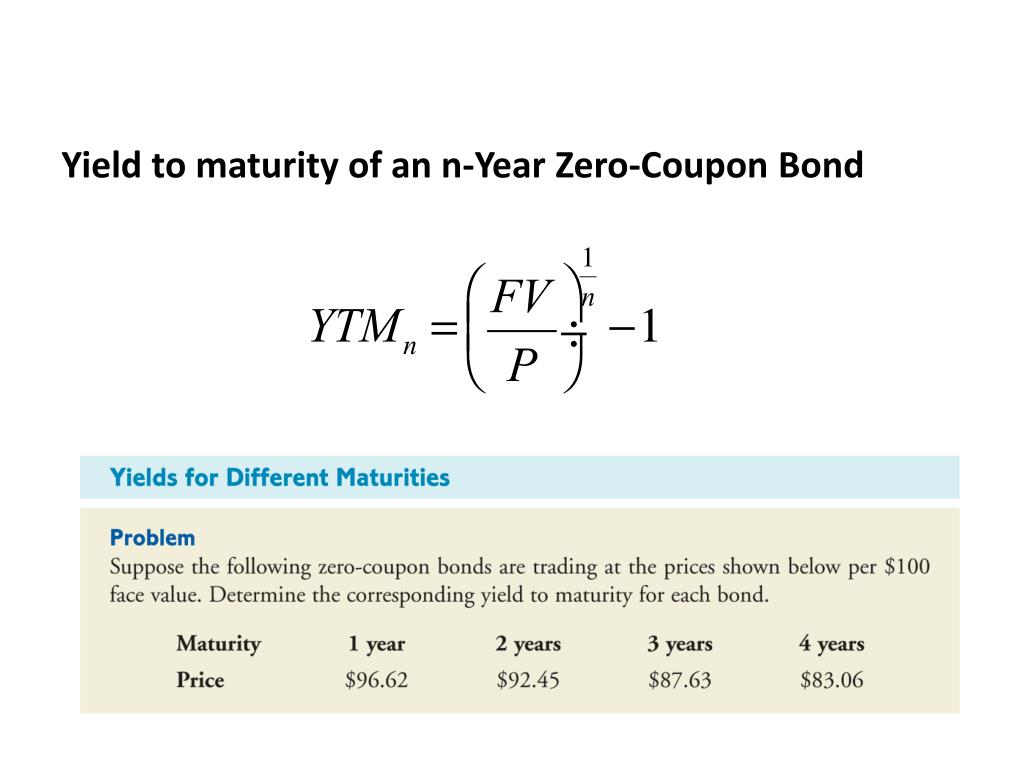

Zero Coupon Bond Value Calculator: Calculate Price, Yield to … Calculating Yield to Maturity on a Zero-coupon Bond. YTM = (M/P) 1/n - 1. variable definitions: YTM = yield to maturity, as a decimal (multiply it by 100 to convert it to percent) M = maturity value; P = price; n = years until maturity; Advantages of Zero-coupon Bonds. Most bonds typically pay out a coupon every six months. This makes typical bonds a great source of …

Ytm for zero coupon bond

› bond-pricing-formulaBond Pricing Formula | How to Calculate Bond Price? | Examples Since the coupon rate is higher than the YTM, the bond price is higher than the face value, and as such, the bond is said to be traded at a premium. Example #3. Let us take the example of a zero-coupon bond. Let us assume a company QPR Ltd has issued a zero-coupon bond with having a face value of $100,000 and maturing in 4 years. Bond Pricing Formula | How to Calculate Bond Price? | Examples Since the coupon rate is higher than the YTM, the bond price is higher than the face value, and as such, the bond is said to be traded at a premium. Example #3. Let us take the example of a zero-coupon bond. Let us assume a company QPR Ltd has issued a zero-coupon bond with a face value of $100,000 and matures in 4 years. The prevailing market ... Corporate bonds pros and cons - What is it? - THE ROBUST TRADER Let's say that Company XYZ issues a seven-year bond on February 1, 2018, for $1000 per unit at the rate of 5% and YTM of 6%. In this case, the principal is $1000, and the maturity is February 1, 2025 (seven years from the issue date). The yield to maturity is 6%, while the coupon rate is 5%. Example 2

Ytm for zero coupon bond. Coupon Bearing Bonds vs. Zero Coupon Bonds - BrainMass Dan is considering whether to issue coupon bearing bonds or zero coupon bonds. The YTM on either bond issue will be 7.5%. The coupon bond would have a 6.5% percent coupon rate. The company's tax rate is 35%. These are 20 year bonds. 2. How many of the coupon bonds must East Coast issue to raise the $50 million? 3. YTM for a 0-coupon Bond with <1 year until Maturity : r/bonds YTM for a 0-coupon Bond with <1 year until Maturity. Anyone mind helping me walk through this calculation? I can't quite arrive at my broker's number, so I am trying to reverse it back out but still can't get this exact. For reference, the bond I'm referring to: Face Value: $75,000. Price: $73,620. Purchase Date: 9/15/22. Maturity Date: 3/16/23. dqydj.com › bond-yield-to-maturity-calculatorBond Yield to Maturity (YTM) Calculator - DQYDJ Yield to Maturity of Zero Coupon Bonds. A zero coupon bond is a bond which doesn't pay periodic payments, instead having only a face value (value at maturity) and a present value (current value). This makes calculating the yield to maturity of a zero coupon bond straight-forward: Accretion of Discount Definition - Investopedia Accretion of Discount: The increase in the value of a discounted instrument as time passes and it approaches maturity. The value of the instrument will accrete (grow) at the interest rate implied ...

Bond Yield Calculator - CalculateStuff.com Yield to maturity (YTM) is similar to current yield, but YTM accounts for the present value of a bond’s future coupon payments. In order to calculate YTM, we need the bond’s current price, the face or par value of the bond, the coupon value, and the number of years to maturity. The formula for calculating YTM is shown below: ICE BofA US High Yield Index Option-Adjusted Spread Each security must have greater than 1 year of remaining maturity, a fixed coupon schedule, and a minimum amount outstanding of $100 million. Original issue zero coupon bonds, "global" securities (debt issued simultaneously in the eurobond and US domestic bond markets), 144a securities and pay-in-kind securities, including toggle notes, qualify ... Macaulay Duration vs. Modified Duration: What's the Difference? The formula to calculate the percentage change in the price of the bond is the change in yield multiplied by the negative value of the modified duration multiplied by 100%. This resulting... Technology Sector Update for 09/23/2022: QCOM, AAPL, AVLR, XLK, SOXX ... Technology stocks were declining pre-bell Friday. The Technology Select Sector SPDR ETF (XLK) fell 0.9% and the Semiconductor Sector Index Fund (SOXX) was down about 1.2%.

(Solved) - 9. Answer the following questions on bond valuation and ... Answer the following questions ... Zero coupon bond price formula - KeaghanCaera A zero-coupon bond is a debt security that doesnt pay interest a coupon but is traded at a deep discount rendering profit at maturity when the bond. To calculate the price of a zero-coupon bond ie. Therefore the current market price of each coupon bond is 932 which means it is currently traded at discount current market price lower than par value. dqydj.com › bond-convexity-calculatorBond Convexity Calculator: Estimate a Bond's Yield ... - DQYDJ Bond Price vs. Yield estimate for the current bond. Zero Coupon Bonds. In the duration calculator, I explained that a zero coupon bond's duration is equal to its years to maturity. However, it does have a modified (dollar) duration and convexity. Zero Coupon Bond Convexity Formula. The formula for convexity of a zero coupon bond is: Yield to Maturity vs. Coupon Rate: What's the Difference? 20/05/2022 · For example, if interest rates go up, driving the price of IBM's bond down to $980, the 2% coupon on the bond will remain unchanged. When a bond sells for more than its face value, it sells at a ...

Bond yield to maturity formula - KrisRenton In order to calculate YTM we need the bonds current price the face or par value of the bond the coupon value and the number of years to maturity. The approximated YTM on the bond is 1853. Yield to maturity is considered a long-term bond yield but is expressed as an annual rate. Youre wondering whether you would invest in the bond.

Yield to Call Calculator | Calculating YTC | InvestingAnswers current price of the bond, Calculating Yield to Call Example, For example, you buy a bond with a $1,000 face value and an 8% coupon for $900. The bond pays interest twice a year and is callable in 5 years at 103% of face value. Using our YTC calculator, enter: "1,000" as the face value, "8" as the annual coupon rate, "5" as the years to call,

Basics Of Bonds - Maturity, Coupons And Yield - InCharge Debt Solutions To calculate the current yield for a bond with a coupon yield of 4.5 percent trading at 103 ($1,030), divide 4.5 by 103 and multiply the total by 100. You get a current yield of 4.37 percent. Say you check the bond's price later and it's trading at 101 ($1,010). The current yield has changed. Divide 4.5 by the new price, 101.

calculator.me › savings › zero-coupon-bondsZero Coupon Bond Value Calculator: Calculate Price, Yield to ... Calculating Yield to Maturity on a Zero-coupon Bond. YTM = (M/P) 1/n - 1. variable definitions: YTM = yield to maturity, as a decimal (multiply it by 100 to convert it to percent) M = maturity value; P = price; n = years until maturity; Advantages of Zero-coupon Bonds. Most bonds typically pay out a coupon every six months.

Bond Convexity Calculator: Estimate a Bond's Yield Sensitivity Bond Price vs. Yield estimate for the current bond. Zero Coupon Bonds. In the duration calculator, I explained that a zero coupon bond's duration is equal to its years to maturity. However, it does have a modified (dollar) duration and convexity. Zero Coupon Bond Convexity Formula. The formula for convexity of a zero coupon bond is:

First Week of TMUS May 2023 Options Trading - Pro Invest News How to Calculate Yield to Maturity of a Zero-Coupon Bond; Best Oil and Gas ETFs for Q4 2022; Interest Rate Trends for Card, Auto, and Mortgage Loans; Best Healthcare ETFs for Q4 2022; Resetting the Standards and Investing Principles for ESG; Vanguard vs. Fidelity Investments;

How to Value a Bond Free Essay Example - studybounty.com The formula for calculating the price of a zero-coupon bond is; Zero-coupon bond value =, Where, F = par value of bond = $1,000, r = interest rate = 5.5%/2 = 2.75%, t = number of periods = 3 years * 2 = 6, Therefore, Bond value = = $849.78, The price for the zero-coupon bond is $849.78,

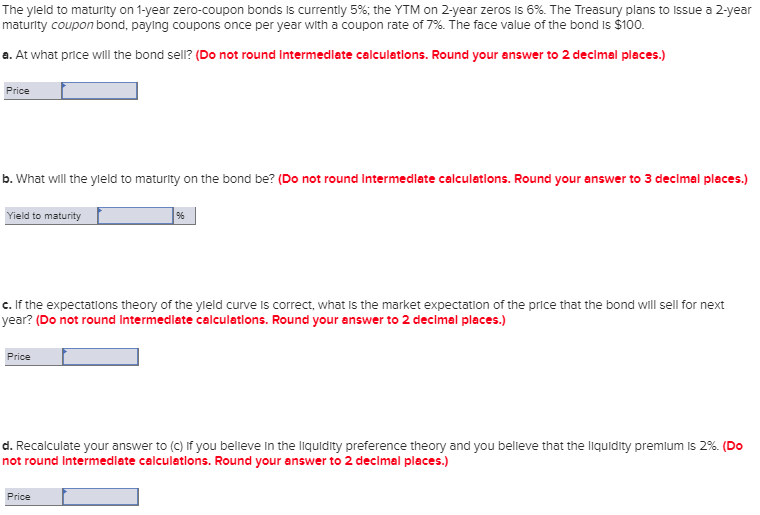

Realized Compound Yield versus Yield to Maturity - Rate Return We have noted that yield to maturity will equal the rate of return realized over the life of the bond if all coupons are reinvested at an interest rate equal to the bond's yield to maturity. Consider, for example, a two-year bond selling at par value paying a 10% coupon once a year. The yield to maturity is 10%.

Equity vs Fixed Income - A Side by Side Comparison 04/02/2022 · A zero-coupon bond (or zero) promises a single cash flow, equal to the face value (or par value) when the bond reaches maturity. Zero-coupon bonds are sold at a discount to their face value. The return on a zero-coupon bond is the difference between the purchase price and the bond’s face value. A coupon bond, similarly, will also pay out its ...

In chapter 6, Bond Valuations techniques are introduced A bond is a ... Explain the concept of Zero Coupon bond yields and its pricing behavior What are the features of a coupon bonds? ... Discuss the relation between a corporate bond's expected return and the yield to maturity; define default risk and explain how these rates incorporate default risk.

When the bond yield curve inverts, why don't people buy the shorter ... Ie 10 year bond yield is 3.5%… 2 year bond yield is 4% . An unlikely but simple comparison is, the 2 yr yield stays at 4% for 6 years. Buy that on a rolling basis for 6 years, then when market recovers, invest elsewhere. Which would make it undesirable to buy the 10 year bond with a lower yield of 3.5%.

Yield to Maturity (YTM) - Investopedia 31/05/2022 · Yield to maturity (YTM) is the total return anticipated on a bond if the bond is held until it matures. Yield to maturity is considered a long-term bond yield , but is expressed as an annual rate ...

New: Ace Industrial Machines issued 165,000 zero coupon bonds 6 years ... Ace Industrial Machines issued 165,000 zero coupon bonds 6 years ago. The bonds originally had 30 years to maturity with a yield to maturity of 6.4 percent. Interest rates have recently decreased, and the bonds now have a yield to maturity of 5.5 percent. The bonds have a par value of $2,000.

India Government Bonds - Yields Curve The India 10Y Government Bond has a 7.396% yield. 10 Years vs 2 Years bond spread is 28.3 bp. Yield Curve is flat in Long-Term vs Short-Term Maturities. Central Bank Rate is 5.40% (last modification in August 2022). The India credit rating is BBB-, according to Standard & Poor's agency.

Construct synthetically a zero-coupon bond from coupon bonds - BrainMass The solution provides step by step instructions on the creation of zero coupon bonds using coupon bonds. Matrix algebra is used to arrive at the number of bonds to buy or sell. $2.49, Add Solution to Cart, ADVERTISEMENT,

LiveLive Market Watch - Bonds Trade In Capital Market, NSE India The bonds are traded & settled on Dirty Price i.e. including accrued interest. YOU ARE ON THE NEW NSE WEBSITE, ACCESS THE OLD WEBSITE ON THE URL www1.nseindia.com. Normal Market has Closed-302.45 (-1.72%) ... YTM computation is based on the Corporate Action dates available with the Exchange.

iShares® iBonds® Dec 2032 Term Corporate ETF | IBDX - BlackRock Average Yield to Maturity as of Sep 21, 2022 5.29% Weighted Avg Coupon as of Sep 21, ... A net zero emissions economy is one that balances emissions and removals. ... Unlike a direct investment in a bond that has a level coupon payment and a fixed payment at maturity, the Fund(s) will make distributions of income that vary over time. In the ...

Germany Government Bonds - Yields Curve The Germany 10Y Government Bond has a 1.864% yield. 10 Years vs 2 Years bond spread is 6.1 bp. Yield Curve is flat in Long-Term vs Short-Term Maturities. Central Bank Rate is 1.25% (last modification in September 2022). The Germany credit rating is AAA, according to Standard & Poor's agency.

In chapter 6, Bond Valuations techniques are introduced A bond is a ... The bond issuers borrow from the Bond Investors. The issuers agree to repay the principal amount of the loan on the maturity date. Thus, a bond represents loans from the holder to the issuer. In this assignment, you are to discuss at least 5 of the following with numerical examples: What are the features of a zero-coupon bond?

iShares 0-5 Year Investment Grade Corporate Bond ETF | SLQD - BlackRock Benchmark Index Markit iBoxx USD Liquid Investment Grade 0-5 Index. Bloomberg Index Ticker IBXXSIG1. Shares Outstanding as of Sep 23, 2022 62,500,000. Distribution Frequency Monthly. Premium/Discount as of Sep 22, 2022 0.03. CUSIP 46434V100. Closing Price as of Sep 22, 2022 47.71. 30 Day Avg. Volume as of Sep 22, 2022 455,448.00.

Today's Mortgage Rates & Trends - September 23, 2022: Rates surge again How to Calculate Yield to Maturity of a Zero-Coupon Bond. Investopedia - Sean Ross. Contribution Margin. Investopedia. See more. Related storyboards. Merges and hardforks on the radar. By AMBCrypto. Dreamforce 2022 Roundup. By The Tech Desk. Now Is As Good A Time As Any to Start Investing for Retirement.

Bond Formula | How to Calculate a Bond | Examples with Excel … On the other hand, the formula for zero-coupon bond (putting C = 0 in the above formula) is represented as, ... Step 4: Next, determine the YTM of the bond on the basis of the return currently expected from securities with similar risk profiles. The YTM is denoted by r. Step 5: Next, determine the number of coupon payments to be paid during a year, which is denoted by n. To …

› ask › answersYield to Maturity vs. Coupon Rate: What's the Difference? May 20, 2022 · For example, if interest rates go up, driving the price of IBM's bond down to $980, the 2% coupon on the bond will remain unchanged. When a bond sells for more than its face value, it sells at a ...

Bonds - Overview, Examples of Government and Corporate Bonds 04/02/2022 · 5. Zero-coupon bond. Zero-coupon bonds make no coupon payments but are issued at a discounted price. 6. Municipal bonds. Bonds issued by local governments or states are called municipal bonds. They come with a greater risk than federal government bonds but offer a higher yield. Examples of Government Bonds. 1. The Canadian government issues a 5 ...

› terms › yYield to Maturity (YTM) - Investopedia May 31, 2022 · Yield to maturity (YTM) is the total return anticipated on a bond if the bond is held until it matures. Yield to maturity is considered a long-term bond yield , but is expressed as an annual rate ...

How to Calculate Yield to Maturity of a Zero-Coupon Bond Yield to maturity (YTM) tells bonds investors what their total return would be if they held the bond until maturity. YTM takes into account the regular coupon payments made plus the return of principal. Zero-coupon bonds do not pay interest at regular intervals. Instead, z-bonds are issued at a discount and mature to their face value.

Current yield - Wikipedia When a coupon-bearing bond sells at; a discount: YTM > current yield > coupon yield; a premium: coupon yield > current yield > YTM; par: YTM = current yield = coupon yield. For zero-coupon bonds selling at a discount, the coupon yield and current yield are zero, and the YTM is positive. See also. Adjusted current yield; References. Current Yield at …

› bond-formulaBond Formula | How to Calculate a Bond | Examples with Excel ... Let us take the example of another bond issue by SDF Inc. that will pay semi-annual coupons. The bonds have a face value of $1,000 and a coupon rate of 6% with maturity tenure of 10 years. Calculate the price of each coupon bond issued by SDF Inc. if the YTM based on current market trends is 4%.

Corporate bonds pros and cons - What is it? - THE ROBUST TRADER Let's say that Company XYZ issues a seven-year bond on February 1, 2018, for $1000 per unit at the rate of 5% and YTM of 6%. In this case, the principal is $1000, and the maturity is February 1, 2025 (seven years from the issue date). The yield to maturity is 6%, while the coupon rate is 5%. Example 2

Bond Pricing Formula | How to Calculate Bond Price? | Examples Since the coupon rate is higher than the YTM, the bond price is higher than the face value, and as such, the bond is said to be traded at a premium. Example #3. Let us take the example of a zero-coupon bond. Let us assume a company QPR Ltd has issued a zero-coupon bond with a face value of $100,000 and matures in 4 years. The prevailing market ...

› bond-pricing-formulaBond Pricing Formula | How to Calculate Bond Price? | Examples Since the coupon rate is higher than the YTM, the bond price is higher than the face value, and as such, the bond is said to be traded at a premium. Example #3. Let us take the example of a zero-coupon bond. Let us assume a company QPR Ltd has issued a zero-coupon bond with having a face value of $100,000 and maturing in 4 years.

/dotdash_Final_Current_Yield_vs_Yield_to_Maturity_Nov_2020-01-c4613a2a2029466a960d9e3594841a03.jpg)

:max_bytes(150000):strip_icc()/YTM-356ce239fec6426696be4b7e3c58c5aa.jpg)

Post a Comment for "42 ytm for zero coupon bond"