40 how to calculate coupon rate from yield

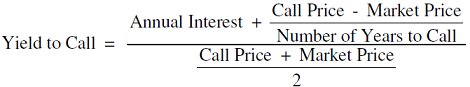

How to Calculate Yield to Call (YTC): Definition, Formula & Example Yield to Call Six years ago the Singleton Company issued 20-year bonds with a 13% annual coupon rate at their $1,000 par value. The bonds had a 8% call premium, with 5 years of call protection. Bond Yield Rate vs. Coupon Rate: What's the Difference? - Investopedia In general, a bond's coupon rate will be comparable with prevailing interest rates when it is first issued. How Do You Calculate Yield Rate? A bond's yield, or coupon rate, is computed by dividing...

Coupon Rate - Meaning, Example, Types | Yield to Maturity Comparision Coupon Rate = Reference Rate + Quoted Margin The quoted margin is the additional amount that the issuer agrees to pay over the reference rate. For example, suppose the reference rate is a 5-year Treasury Yield, and the quoted margin is 0.5%, then the coupon rate would be - Coupon Rate = 5-Year Treasury Yield + .05%

How to calculate coupon rate from yield

How to Calculate Current Yield (Formula and Examples) Individual bonds pay a fixed sum of money, also called a coupon or nominal yield, each year. You can typically find this as a percentage of the bond's face value or a coupon rate. The formula for coupon rate is: Coupon rate = (total annual coupon payment / par value of bond) x 100 Bond Price Calculator | Formula | Chart coupon per period = face value * coupon rate / frequency As this is an annual bond, the frequency = 1. And the coupon for Bond A is: ($1,000 * 5%) / 1 = $50. Determine the years to maturity. The n is the number of years it takes from the current moment to when the bond matures. The n for Bond A is 10 years. Determine the yield to maturity (YTM). Calculate Bond Price from Yield in Excel (3 Easy Ways) Use the below formula in the C10 cell to find the Coupon Bond Price. =C9* (1- (1+ (C7 /C6))^ (-C6*C5 ))/ (C7/C6)+ (C4/ (1 + (C7/C6))^ (C6*C5)) Use the ENTER key to display the Coupon Bond Price. How to Calculate Bond Price with Negative Yield in Excel (2 Easy Ways) Method 2: Using FV Function to Calculate Bond Price from Yield in Excel

How to calculate coupon rate from yield. Calculating Tax Equivalent Yield on Municipal Bonds - The Balance Here's how you calculate the TEY in a few steps: Find the reciprocal of your tax rate (1 - your tax rate). If you pay 25% tax, your reciprocal would be (1 - .25) = .75, or 75%. Divide this amount into the yield on the tax-free bond to find out the TEY. For example, if the bond in question yields 3%, use (3.0 / .75) = 4%. Yield - Definition, Overview, Examples and Percentage Yield Formula The average yield of stocks on the S&P 500, for example, typically ranges between 2.0 - 4.0%. Percent Yield Formula. The percent yield formula is a way of calculating the annual income-only return on an investment by placing income in the numerator and cost (or market value) in the denominator. Percentage yield formula: YIELD Function - Formula, Examples, Calculate Yield in Excel The YIELD Function [1] is categorized under Excel Financial functions. It will calculate the yield on a security that pays periodic interest. The function is generally used to calculate bond yield. As a financial analyst, we often calculate the yield on a bond to determine the income that would be generated in a year. What Is the Coupon Rate of a Bond? - The Balance How Coupon Rates Work A coupon rate is the annual amount of interest paid by the bond stated in dollars, divided by the par or face value. For example, a bond that pays $30 in annual interest with a par value of $1,000 would have a coupon rate of 3%.

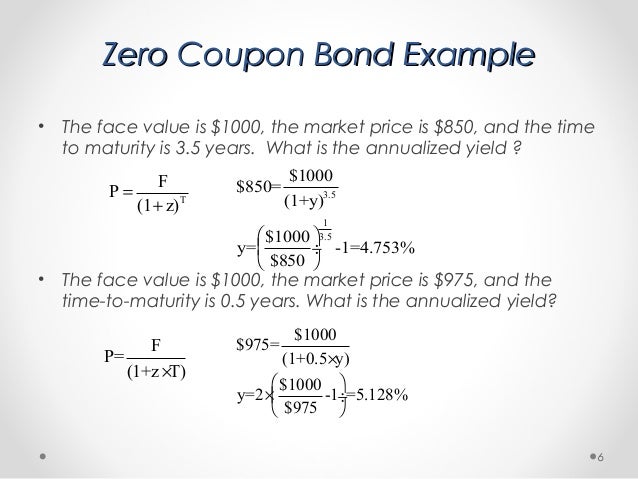

How to Calculate Yield to Maturity of a Zero-Coupon Bond The formula for calculating the yield to maturity on a zero-coupon bond is: \begin {aligned}&\text {Yield To Maturity}\\&\qquad=\left (\frac {\text {Face Value}} {\text {Current Bond... Coupon Rate - Meaning, Calculation and Importance - Scripbox To calculate the couponrate for Company A's bond, we need to know the total annual interest payments. Total Annual Interest Payments = 50 + 50 = 100 Coupon Rate = 100 / 500 * 100 = 20% Therefore, the coupon rate for the Company A bond is 20%. Importance of Coupon Rate in Bonds Bonds pay interest to their holders. Difference Between Current Yield and Coupon Rate The main difference between the current yield and coupon rate is that the current yield is just an expected return from a bond, and the coupon rate is the actual amount paid regularly for a bond till it gets mature. The Current Yield keeps changing as the market value of the bond changes, but the Coupon Rate of a particular bond remains the ... Coupon Rate - Learn How Coupon Rate Affects Bond Pricing Assuming that the price of the bond increases to $1,500, then the yield-to-maturity changes from 2% to 1.33% ($20/$1,500= 1.33%). If the price of the bond falls to $800, then the yield-to-maturity will change from 2% to 2.5% ( i.e., $20/$800= 2.5%). The yield-to-maturity only equals the coupon rate when the bond sells at face value.

Bond Yield: Definition & Calculation with Interest Rates The yield will differ from the coupon rate if the price of a bond is above or below face value. Types of Bond Yields. ... How To Calculate a Bond Price. In all bond yield calculations, if you know ... How Can I Calculate a Bond's Coupon Rate in Excel? - Investopedia In cell B2, enter the formula "=A3/B1" to yield the annual coupon rate of your bond in decimal form. Finally, select cell B2 and hit CTRL+SHIFT+% to apply percentage formatting. For example, if a... YIELD function (DAX) - DAX | Microsoft Docs $\text{E}$ = number of days in the coupon period. If there is more than one coupon period until redemption, YIELD is calculated through a hundred iterations. The resolution uses the Newton method, based on the formula used for the function PRICE. The yield is changed until the estimated price given the yield is close to price. Coupon Rate: Definition, Formula & Calculation - Study.com A newly issued bond pays its coupons once a year. Its coupon rate is 4%, its maturity is 10 years, and its yield to maturity is 7%. a. Find the holding-period return for a one-year investment perio

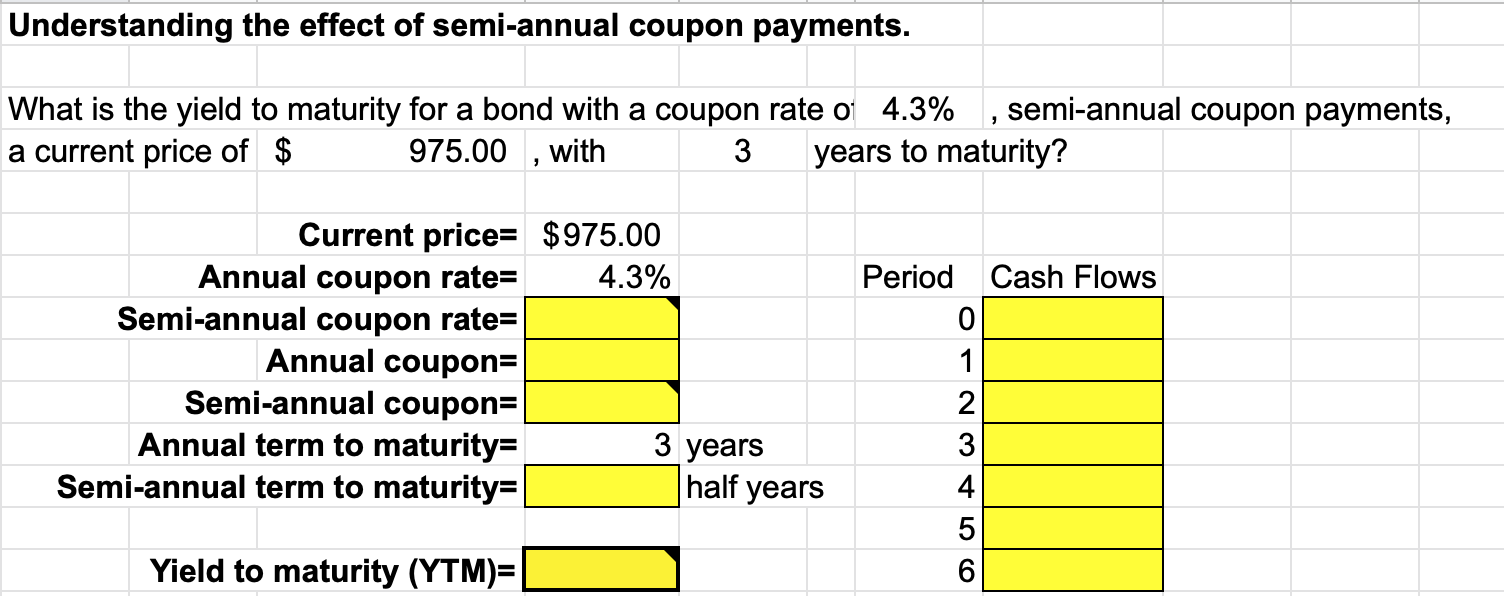

How to calculate yield to maturity in Excel (Free Excel Template) RATE (nper, pmt, pv, [fv], [type], [guess]) Here, Nper = Total number of periods of the bond maturity. The years to maturity of the bond is 5 years. But coupons per year are 2. So, nper is 5 x 2 = 10. Pmt = The payment made in every period. It cannot change over the life of the bond. The coupon rate is 6%.

Yield to Maturity vs. Coupon Rate: What's the Difference? - Investopedia To calculate the bond's coupon rate, divide the total annual interest payments by the face value. In this case, the total annual interest payment equals $10 x 2 = $20. The annual coupon rate for...

Yield to Maturity (YTM) - Overview, Formula, and Importance On this bond, yearly coupons are $150. The coupon rate for the bond is 15% and the bond will reach maturity in 7 years. The formula for determining approximate YTM would look like below: The approximated YTM on the bond is 18.53%. Importance of Yield to Maturity

How to calculate corporate bonds Z spreads having yield to maturities ... Note that you need to know the bond's cash flows in order to discount them, and in order to calculate the price from the yield that you are given. You have the coupon payment frequency (annual), but you need to know how the coupon rate as well. If you don't have the coupon rates that you need to do this precisely, then you can estimate the Z ...

Effective Yield - Overview, Formula, Example, and Bond Equivalent Yield Effective Yield = [1 + (i/n)] n - 1 Where: i - The nominal interest rate on the bond n - The number of coupon payments received in each year Practical Example Assume that you purchase a bond with a nominal coupon rate of 7%. Coupon payments are received, as is common with many bonds, twice a year.

How to Calculate the Bond Duration (example included) Therefore, for our example, m = 2. Here is a summary of all the components that can be used to calculate Macaulay duration: m = Number of payments per period = 2. YTM = Yield to Maturity = 8% or 0.08. PV = Bond price = 963.7. FV = Bond face value = 1000. C = Coupon rate = 6% or 0.06. Additionally, since the bond matures in 2 years, then for ...

Quant Bonds - Between Coupon Dates Quant Bonds - Between Coupon Dates Yield Between Coupon Dates There are several ways you can calculate the yield to maturity for dates that fall between coupon dates: 1) Using the IRR function 2) Using the YIELD function 3) Using the XIRR function 4) Using the Secant Method 5) Using the Bisection Method 6) Using the Newton Raphson Assumptions

How to Calculate Yield to Call (With Definition and Example) Assuming the bond issuer pays a coupon rate of 10% annually, multiply it by the bond's face value, which is $1,000, to find the coupon payment. Considering that 10% is 10/100, you can multiply it by $1,000 to get an annual coupon payment of $100. $900 = (100 / 2) x { (1 - (1 + YTC / 2) ^ -2t) / (YTC / 2)} + (CP / (1 + YTC / 2) ^ 2t) 3.

Coupon Rate Definition - Investopedia The coupon rate, or coupon payment, is the nominal yield the bond is stated to pay on its issue date. This yield changes as the value of the bond changes, thus giving the bond's yield to maturity...

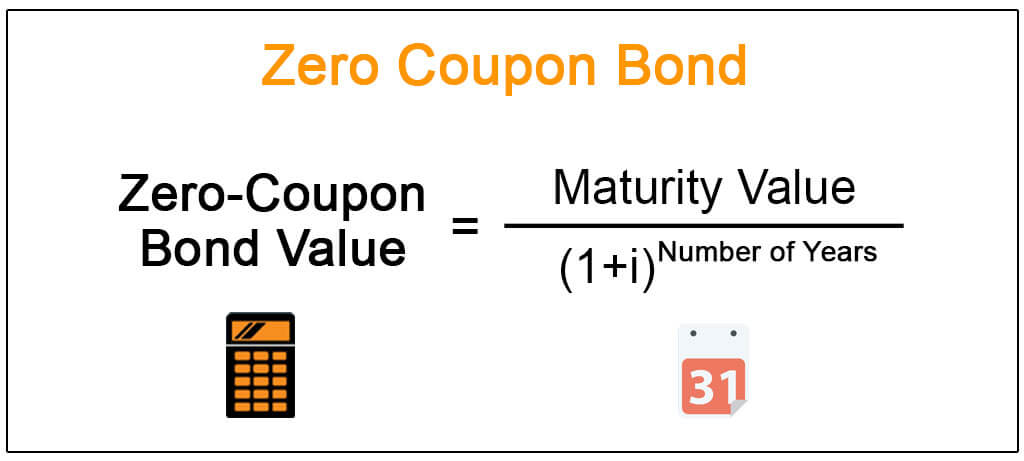

How do I Calculate Zero Coupon Bond Yield? - Smart Capital Mind Zero coupon bond yield is calculated by using the present value equation and solving it for the discount rate. The resulting rate is the yield. It is both the discount rate that is revealed by the market situation and the return rate that investors expect from the bond. The zero coupon bond yield helps investors decide whether to invest in bonds.

Calculate Bond Price from Yield in Excel (3 Easy Ways) Use the below formula in the C10 cell to find the Coupon Bond Price. =C9* (1- (1+ (C7 /C6))^ (-C6*C5 ))/ (C7/C6)+ (C4/ (1 + (C7/C6))^ (C6*C5)) Use the ENTER key to display the Coupon Bond Price. How to Calculate Bond Price with Negative Yield in Excel (2 Easy Ways) Method 2: Using FV Function to Calculate Bond Price from Yield in Excel

Bond Price Calculator | Formula | Chart coupon per period = face value * coupon rate / frequency As this is an annual bond, the frequency = 1. And the coupon for Bond A is: ($1,000 * 5%) / 1 = $50. Determine the years to maturity. The n is the number of years it takes from the current moment to when the bond matures. The n for Bond A is 10 years. Determine the yield to maturity (YTM).

How to Calculate Current Yield (Formula and Examples) Individual bonds pay a fixed sum of money, also called a coupon or nominal yield, each year. You can typically find this as a percentage of the bond's face value or a coupon rate. The formula for coupon rate is: Coupon rate = (total annual coupon payment / par value of bond) x 100

:max_bytes(150000):strip_icc()/dotdash_INV-final-How-Can-I-Calculate-a-Bonds-Coupon-Rate-in-Excel-June-2021-01-8ff43b6e77a4475fb98d82707a90fae0.jpg)

Post a Comment for "40 how to calculate coupon rate from yield"