41 coupon rate treasury bond

What Is Coupon Rate and How Do You Calculate It? Every six months it pays the holder $50. To calculate the bond coupon rate we add the total annual payments then divide that by the bond's par value: ($50 + $50) = $100. $100 / $1,000 = 0.10. The bond's coupon rate is 10 percent. This is the portion of its value that it repays investors every year. Important Differences Between Coupon and Yield to Maturity A bond has a variety of features when it's first issued, including the size of the issue, the maturity date, and the initial coupon. For example, the U.S. Treasury might issue a 30-year bond in 2019 that's due in 2049 with a coupon of 2%. This means that an investor who buys the bond and owns it until 2049 can expect to receive 2% per year for ...

United States Rates & Bonds - Bloomberg Treasury Inflation Protected Securities (TIPS) Name. Coupon. Price. Yield. 1 Month. 1 Year. Time (EDT) GTII5:GOV.

Coupon rate treasury bond

Coupon Interest and Yield for eTBs - australiangovernmentbonds The Coupon Interest Rate on a Treasury Bond is set when the bond is first issued by the Australian Government, and remains fixed for the life of the bond. For example, a Treasury Bond with a 5% Coupon Interest Rate will pay investors $5 a year per $100 Face Value amount in instalments of $2.50 every six months. › terms › cCoupon Rate Definition - Investopedia Sep 05, 2021 · Coupon Rate: A coupon rate is the yield paid by a fixed-income security; a fixed-income security's coupon rate is simply just the annual coupon payments paid by the issuer relative to the bond's ... › ask › answersHow Is the Interest Rate on a Treasury Bond Determined? Feb 05, 2020 · A Treasury bond pays a "coupon rate." This is the percentage return paid to the investor periodically until its maturity date. Treasury bonds also are traded in the market. As fewer payments ...

Coupon rate treasury bond. What Is a Coupon Rate? - Investment Firms A coupon rate, also known as coupon payment, is the rate of interest paid by bond issuers on a bond's face value. Generally, a coupon rate is calculated by summing up the total number of coupons paid per year and dividing it by its bond face value. So regardless of what goes on with the market, your coupon rate stays the same. www2.asx.com.au › bond-derivativesBond derivatives - Australian Securities Exchange Gain exposure to Australian debt markets by trading ASX Treasury Bond Futures and Options. Underpinned by a basket of liquid Australian Government Bonds, the 3, 5, 10 and 20 Year Treasury Bond Futures are a cost effective tool that can be used to enhance portfolio performance, manage duration, hedge risk exposures and take advantage of curve and spread trading opportunities. Coupon Rate Formula | Step by Step Calculation (with Examples) The formula for coupon rate is computed by dividing the sum of the coupon payments paid annually by the par value of the bond and then expressed in terms of percentage. Coupon Rate = Total Annual Coupon Payment / Par Value of Bond * 100% You are free to use this image on your website, templates etc, Please provide us with an attribution link Coupon Rate - Learn How Coupon Rate Affects Bond Pricing The coupon rate represents the actual amount of interest earned by the bondholder annually, while the yield-to-maturity is the estimated total rate of return of a bond, assuming that it is held until maturity. Most investors consider the yield-to-maturity a more important figure than the coupon rate when making investment decisions.

Treasury Coupon Issues | U.S. Department of the Treasury The Yield Curve for Treasury Nominal Coupon Issues (TNC yield curve) is derived from Treasury nominal notes and bonds. The Yield Curve for Treasury Real Coupon Issues (TRC yield curve) is derived from Treasury Inflation-Protected Securities (TIPS). The Treasury Breakeven Inflation Curve (TBI curve) is derived from the TNC and TRC yield curves ... › bond-basics-417057Bond Basics: Issue Size and Date, Maturity Value, Coupon May 28, 2022 · Coupon and Yield to Maturity . The coupon rate is the periodic interest payment that the issuer makes during the life of the bond. For instance, a bond with a $10,000 maturity value might offer a coupon of 5%. Then, you can expect to receive $500 each year until the bond matures. Coupon Rate of a Bond (Formula, Definition) - WallStreetMojo The coupon rate of a bond can be calculated by dividing the sum of the annual coupon payments by the par value of the bond and multiplied by 100%. Therefore, the rate of a bond can also be seen as the amount of interest paid per year as a percentage of the face value or par value of the bond. Mathematically, it is represented as, Series I Savings Bonds Rates & Terms: Calculating Interest Rates your I bond Composite rate for your six-month earning period starting during May - October 2022 (See "When does my bond change rates?") From: Through: May 2022: Oct. 2022: 9.62%: Nov. 2021: Apr. 2022: 9.62%: May 2021: Oct. 2021: 9.62%: Nov. 2020: Apr. 2021: 9.62%: May 2020: Oct. 2020: 9.62%: Nov. 2019: Apr. 2020: 9.83%: May 2019: Oct. 2019: 10.14%: Nov. 2018: Apr. 2019: 10.14%: May 2018

United Kingdom Government Bonds - Yields Curve The United Kingdom 10Y Government Bond has a 2.190% yield. 10 Years vs 2 Years bond spread is 41 bp. Normal Convexity in Long-Term vs Short-Term Maturities. Central Bank Rate is 1.25% (last modification in June 2022). The United Kingdom credit rating is AA, according to Standard & Poor's agency. Individual - Treasury Bonds: Rates & Terms Paper Bonds or Electronic Bonds. Today we issue Treasury bonds in electronic form. We used to issue Treasury bonds in paper form. The last paper bonds matured in 2016. For information on paper Treasury bonds, contact us: Send an e-mail; Call 844-284-2676 (toll free) Write to: Treasury Retail Securities Services P.O. Box 9150 Minneapolis, MN 55480-9150 List of eTBs | australiangovernmentbonds Exchange-traded Treasury Bonds (eTBs) quoted on the Australian Securities Exchange (ASX) are listed below. Delayed market prices for eTBs are published by the ASX at the following link: Delayed prices for eAGBs. To learn more about prices and yields, see ASX 's Online Education Course on Exchange-traded Australian Government Bonds. Maturity Date. Treasury Bonds Rates - WealthTrust Securities Limited A Treasury Bond (T-Bond) is a zero default-risk, extremely liquid medium to long term debt instrument issued by the CBSL which consists of maturity period ranging from 2 to 25 years with semiannual coupon payments. ... Depending on the yield and the coupon rate, the price (per 100 rupees) of a T-Bond, can either be more than Rs. 100 (premium ...

Understanding Coupon Rate and Yield to Maturity of Bonds To translate this to quarterly payment, first, multiply the coupon rate net of 20% final withholding taxes by the face value (1.900% x 1,000,000). Then, divide the resulting annual amount by 4. Here's a sample of how you can compute your expected coupon income from your bond: Php 4,750.00 is the income you can expect to receive quarterly.

What Is the Coupon Rate of a Bond? - The Balance ABC bond's coupon rate was 3%, based on a par value of $1,000 for the bond. This translates to $30 of interest paid each year. Let's say Investor 1 purchases the bond for $900 in the secondary market but still receives the same $30 in interest. This translates to a current yield of 3.33%.

ycharts.com › indicators › us_10year_government_bondUS 10-Year Government Bond Interest Rate - YCharts Mar 31, 2022 · In depth view into US 10-Year Government Bond Interest Rate including historical data from 1974, charts and stats. 3.13% for Jun 2022 Overview

Treasury Bonds: Are They a Good Retirement Investment? Treasury bonds earn a fixed rate of interest. The interest rate is set when the bonds are issued, and it is expressed as an annual rate and paid in two semi-annual payments. So, if you purchase a 30-year Treasury bond with an interest rate of 5.00%, you will receive 60 payments of $2.50 each, for a total of $150, over the life of the bond.

Treasury Bond (T-Bond) - Overview, Mechanics, Example Current Yield = 1 Year Coupon Payment / Bond Price = $25 / $950 = 2.63% Yield to Maturity (YTM) = 2.83% The yield to maturity (YTM) is essentially the internal rate of return (IRR) earned by an investor who holds the bond until maturity, assuming all coupon payments are made as scheduled and reinvested at the same rate.

Coupon (finance) - Wikipedia In finance, a coupon is the interest payment received by a bondholder from the date of issuance until the date of maturity of a bond.. Coupons are normally described in terms of the "coupon rate", which is calculated by adding the sum of coupons paid per year and dividing it by the bond's face value.For example, if a bond has a face value of $1,000 and a coupon rate of 5%, then it pays total ...

US Treasury Zero-Coupon Yield Curve - NASDAQ - Datastore Refreshed 10 hours ago, on 7 Jul 2022 ; Frequency daily; Description These yield curves are an off-the-run Treasury yield curve based on a large set of outstanding Treasury notes and bonds, and are based on a continuous compounding convention. Values are daily estimates of the yield curve from 1961 for the entire maturity range spanned by outstanding Treasury securities.

Understanding Treasury Bond Interest Rates | Bankrate What do Treasury bonds pay? Imagine a 30-year U.S. Treasury Bond is paying around a 1.25 percent coupon rate. That means the bond will pay $12.50 per year for every $1,000 in face value (par value)...

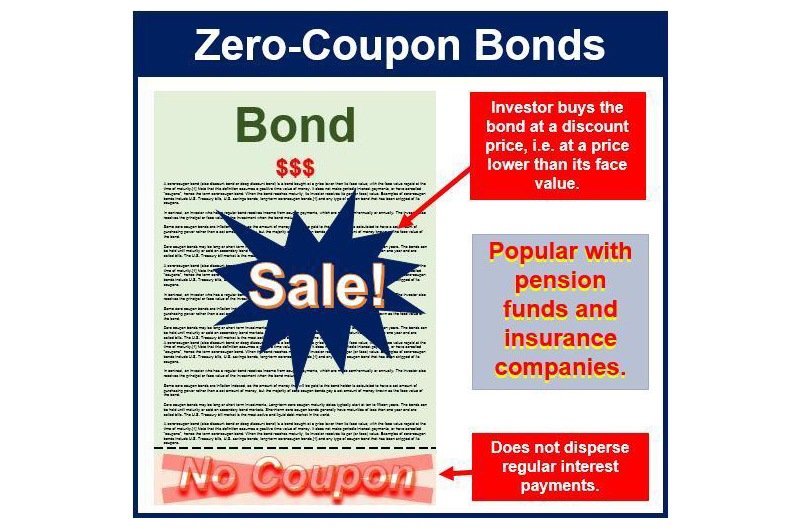

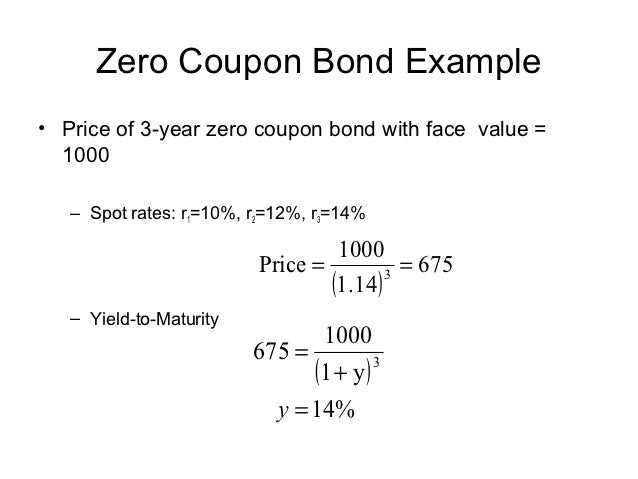

corporatefinanceinstitute.com › zero-coupon-bondZero-Coupon Bond - Definition, How It Works, Formula Jan 28, 2022 · Therefore, a zero-coupon bond must trade at a discount because the issuer must offer a return to the investor for purchasing the bond. Pricing Zero-Coupon Bonds. To calculate the price of a zero-coupon bond, use the following formula: Where: Face value is the future value (maturity value) of the bond; r is the required rate of return or ...

U.S. Treasury Confirms I Bonds Will Pay A 9.62% Interest Rate With inflation increasing this year to multi-decade highs, I Bonds bought from May until Monday, October 31, will pay an annualized interest rate of 9.62%. Keep in mind that the 9.62% rate is an ...

› markets › interest-ratesU.S. Treasury Bond Futures Quotes - CME Group Discover a streamlined approach to trading interest rate markets with Micro Treasury Yield futures, contracts based directly on yields of the most recently auctioned Treasury securities at key tenor points across the curve. ... U.S. Treasury Bond Yield Curve Analytics ... volatility, auctions, coupon issuance projections, and more. STIR ...

US Treasury Bonds - Fidelity US Treasury bonds: $1,000: Coupon: 30-year: Interest paid semi-annually, principal at maturity: Treasury inflation-protected securities (TIPS) $1,000: Coupon: 5-, 10-, and 30-year: Interest paid semi-annually, principal redeemed at the greater of their inflation-adjusted principal amount or the original principal amount: US Treasury floating rate notes (FRNs) $1,000

Treasury Bonds | CBK TWO YEAR FIXED COUPON, TREASURY BOND ISSUE FXD 3/2010/2 DATED SEPTEMBER 27, 2010: 06/08/2010: 9-YEAR GOVERNMENT OF KENYA, INFRASTRUCTURE BOND ISSUE NO. IFB 2/2010/9 DATED AUGUST 30, 2010: ... Find the bond's coupon rate, maturity date and issue date using our Treasury Bonds Results table above. You'll find a full schedule of the bond's ...

Treasury Bonds | AOFM Treasury Bond lines. Coupon and Maturity (click for term sheet) Outstanding. (face value, AUD ...

US30Y: U.S. 30 Year Treasury - Stock Price, Quote and News - CNBC Coupon 2.875%; Maturity 2052-05-15; Latest On U.S. 30 Year Treasury. Treasury yields extend gains; bond markets still flash recession warning signal 8 Hours Ago CNBC.com.

Treasury Coupon Issues and Corporate Bond Yield Curves Treasury Coupon Issues Learn about the Treasury Yield Curves for Nominal and Real Coupon Issues (TNC and TRC yield curves) and The Treasury Breakeven Inflation Curve (TBI curve). Corporate Bond Yield Curve Papers and Data Learn about the corporate bond yield curve, and how it relates to the Pension Protection Act, by downloading these papers.

› ask › answersHow Is the Interest Rate on a Treasury Bond Determined? Feb 05, 2020 · A Treasury bond pays a "coupon rate." This is the percentage return paid to the investor periodically until its maturity date. Treasury bonds also are traded in the market. As fewer payments ...

Post a Comment for "41 coupon rate treasury bond"