40 irs quarterly payment coupon

DES: Quarterly Tax Payment Voucher - English Quarterly Tax Payment Voucher. DES Central Office Location: 700 Wade Avenue Raleigh, NC 27605 Please note that this is a secure facility. IRS reminder to many: Make final 2021 quarterly tax ... Taxpayers who paid too little tax during 2021 can still avoid a surprise tax-time bill and possible penalty by making a quarterly estimated tax payment now, directly to the Internal Revenue Service. The deadline for making a payment for the fourth quarter of 2021 is Tuesday, January 18, 2022. Income taxes are pay-as-you-go.

PDF Sample Tax Payment Coupon - Michigan Sample Tax Payment Coupon - Michigan

Irs quarterly payment coupon

PDF TC-546 Individual Income Tax Prepayment Coupon Mail or deliver the coupon below with your payment to: Income Tax Prepayment Utah State Tax Commission 210 N 1950 W Salt Lake City, UT 84134-0266 For more information 801-297-2200, 1-800-662-4335 (if outside the Salt Lake area), tax.utah.gov. Electronic Payment You may pay your tax due online at tap.utah.gov. Payment Worksheet TurboTax included vouchers for estimated tax payme... I also have quarterly vouchers (on my filing .pdf) and don't owe this year. I would ignore it (which I have done in the past) but on the.pdf for filing it says where the form would be "Do Not File - Form Not Final". The payment voucher is there at the bottom of the page but the text above the dotted line just says "Do Not File - Form Not Final". Quarterly Estimated Tax Payments - Who Needs to pay, When ... January 15 of the following year - for September, October, November, and December. You can pay for your estimated taxes if you have an over-payment from the previous tax year. For example, let's say you're required to make quarterly payments of $4,000 each. But you have a $3,000 over-payment from the previous tax year.

Irs quarterly payment coupon. Payment Vouchers - Michigan Payment Vouchers. Below are the vouchers to remit your Sales, Use and Withholding tax payment (s): 2021 Payment Voucher. 2020 Payment Voucher. 2019 Payment Voucher. 2018 Payment Voucher. 2017 Payment Voucher. 2016 Payment Voucher. 2015 Payment Voucher. › pub › irs-pdf2022 Form 1040-ES - IRS tax forms Internal Revenue Service Purpose of This Package Use Form 1040-ES to figure and pay your estimated tax for 2022. Estimated tax is the method used to pay tax on income that isn't subject to withholding (for example, earnings from self-employment, interest, dividends, rents, alimony, etc.). In addition, if you don't elect voluntary withholding, Make a Payment - Minnesota Department of Revenue Individuals: Use the e-Services Payment System Some tax software lets you make or schedule payments when you file. To cancel a payment made through tax software, you must contact us. Call 651-556-3000 or 1-800-657-3666 (toll-free) at least three business days before the scheduled payment date. Businesses: Log in to e-Services Estimated Taxes | Internal Revenue Service - IRS tax forms This additional expanded penalty relief for tax year 2018 means that the IRS is waiving the estimated tax penalty for any taxpayer who paid at least 80 percent of their total tax liability during the year through federal income tax withholding, quarterly estimated tax payments or a combination of the two.

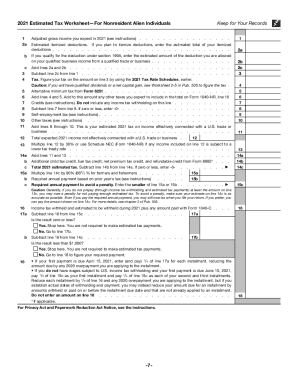

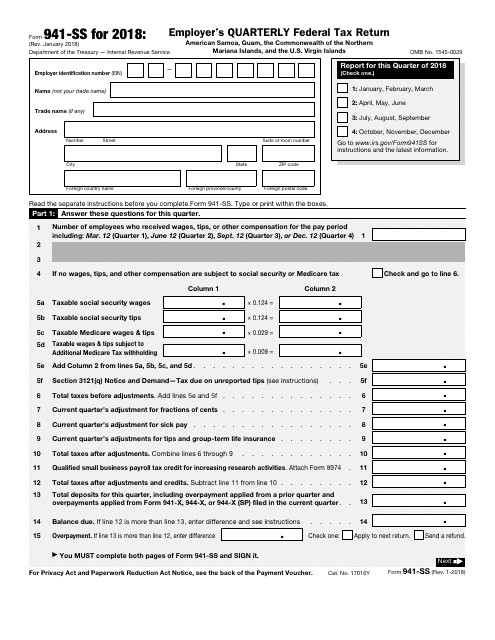

PDF 2021 Form 1040-ES - IRS tax forms $5,400* *Only if married filing jointly. If married filing separately, these amounts do not apply. Your standard deduction is zero if (a) your spouse itemizes on a separate return, or (b) you were a dual-status alien and you do not elect to be taxed as a resident alien for 2021. Social security tax. PDF 2022 Pa-40 Es Individual DECLARATION OF ESTIMATED PERSONAL INCOME TAX DECLARATION OF ESTIMATED PERSONAL INCOME TAX (PA-40 ES) Use the 2022 Form PA-40 ES-I to make your quarterly estimated payment of tax owed. Do not use this voucher for any other purpose. Follow the instructions below. SOCIAL SECURITY NUMBER (SSN) SSN - enter the primary taxpayer's nine-digit SSN PDF Form 941 for 2022: Employer's QUARTERLY Federal Tax Return Payment Voucher Purpose of Form Complete Form 941-V if you're making a payment with Form 941. We will use the completed voucher to credit your payment more promptly and accurately, and to improve our service to you. Printable 2021 Federal Form 1040-V (Payment Voucher) File Now with TurboTax. We last updated Federal Form 1040-V in January 2022 from the Federal Internal Revenue Service. This form is for income earned in tax year 2021, with tax returns due in April 2022. We will update this page with a new version of the form for 2023 as soon as it is made available by the Federal government.

PDF 2022 Form OW-8-ES Oklahoma Individual Estimated Tax Year ... After this estimated tax payment is processed, you will receive a pre-printed coupon each quarter. Please use the pre-printed coupon to make further tax payments. Name Address City State IP 2022 Mail this coupon, along with payment, to: Oklahoma Tax Commission - PO Box 269027 - Oklahoma City, OK 73126-9027 Montana Individual Income Tax Payment Voucher (Form IT ... Montana Department of Revenue. PO Box 6308. Helena, MT 59604-6308. Translate ». Montana Individual Income Tax Resources. The Department of Revenue works hard to ensure we process everyone's return as securely and quickly as possible. Unfortunately, it can take up to 90 days to issue your refund and we may need to ask you to verify your return. Estimated Quarterly Tax Payments: 1040-ES Guide & Dates The IRS allows you to submit estimated quarterly tax payments in the following ways: Pay Estimated Taxes by Mail. To make your estimated quarterly tax payments by mail, tear off the voucher at the bottom of Form 1040-ES and mail it to the IRS. Include a check or money order for your payment. You don't have to include the worksheet with your ... 2022 Federal Quarterly Estimated Tax Payments | It's Your Yale 2022 Federal Quarterly Estimated Tax Payments Generally, the Internal Revenue Service (IRS) requires you to make quarterly estimated tax payments for calendar year 2022 if both of the following apply: you expect to owe at least $1,000 in federal tax for 2022, after subtracting federal tax withholding and refundable credits, and

Payment Vouchers | Arizona Department of Revenue Payment Vouchers. AZ‑140V. Arizona Individual Income Tax payment Voucher for Electronic Filing (This form has no separate instructions) Payment Vouchers. MET-1V. Arizona Marijuana Excise Tax Return Efile Return Payment Voucher. Payment Vouchers. TPT-V. Arizona Transaction Privilege Tax Efile Return Payment Voucher.

PDF 540-ES Form 1 at bottom of page Payment Form 2 Amount of payment File and Pay by June 15, 2022 00 Do not combine this payment with payment of your tax due for 202 1 Using black or blue ink, make your check or money order payable to the "Franchise Tax Board." Write your social security number or individual taxpayer identification number and "2022 Form 540-ES" on it.

PDF 2022 Ohio IT 1040ES Voucher 1 - Due April 18, 2022 ... Once you have calculated your estimated payments, you must pay them quarterly through any of the following methods: Online - Pay via electronic check, debit card or credit card using the Department's Online Services or Guest Payment Service at tax.ohio.gov/pay. By Phone - Pay by credit or debit card by calling ACI Payments

About Form 1040-V, Payment Voucher | Internal Revenue Service Information about Form 1040-V, Payment Voucher, including recent updates, related forms and instructions on how to file. Submit this statement with your check or money order for any balance due on the "Amount you owe" line of your Form 1040 or Form 1040-SR, or 1040-NR.

What do I do with the Payment Voucher? - Intuit Form 1040-V: Payment Voucher (not to be confused with 1040-ES: Estimated Tax Voucher) is an optional IRS form that you include with your check or money order when you mail your tax payment.. Although the IRS will gladly accept your payment without the 1040-V, including it enables the IRS to process your payment more efficiently.

How do I print estimated tax vouchers for my 2022 taxes? Answer Yes and we'll include your 2022 1040-ES payment vouchers when you print a copy of your return later. If you get the No Payments screen instead, you don't need to make 2022 estimated payments based on what you entered; To check that the forms were added to your return, you can go to Tax Tools in the left menu, then Tools.

Online Payment Vouchers - Louisiana Online Payment Vouchers. Welcome to the Louisiana Department of Revenue's Online Payment Voucher System. This is a wizard based application that walks you through the process of generating a payment voucher that you may use to mail in a payment to the department. If you are unsure which voucher type you need to print, click the help icon next ...

› payPayments | Internal Revenue Service Pay from Your Bank Account For individuals only. No registration required. No fees from IRS. Schedule payments up to a year in advance. Pay Now with Direct Pay Pay by Debit Card, Credit Card or Digital Wallet (e.g., PayPal) For individuals and businesses (not for payroll tax deposits). Processing fees apply. Pay Now by Card or Digital Wallet

2022 1040-ES Form and Instructions - Income Tax Pro Roughly each quarter you will mail an estimated tax payment voucher with a check to the IRS. Here are the quarterly due dates for the 2022 tax year: April 18, 2022 June 15, 2022 September 15, 2022 January 17, 2023 Each quarterly estimated tax payment should be postmarked on or before the quarterly due date.

Quarterly Estimated Tax Payments - Who Needs to pay, When ... January 15 of the following year - for September, October, November, and December. You can pay for your estimated taxes if you have an over-payment from the previous tax year. For example, let's say you're required to make quarterly payments of $4,000 each. But you have a $3,000 over-payment from the previous tax year.

TurboTax included vouchers for estimated tax payme... I also have quarterly vouchers (on my filing .pdf) and don't owe this year. I would ignore it (which I have done in the past) but on the.pdf for filing it says where the form would be "Do Not File - Form Not Final". The payment voucher is there at the bottom of the page but the text above the dotted line just says "Do Not File - Form Not Final".

PDF TC-546 Individual Income Tax Prepayment Coupon Mail or deliver the coupon below with your payment to: Income Tax Prepayment Utah State Tax Commission 210 N 1950 W Salt Lake City, UT 84134-0266 For more information 801-297-2200, 1-800-662-4335 (if outside the Salt Lake area), tax.utah.gov. Electronic Payment You may pay your tax due online at tap.utah.gov. Payment Worksheet

Post a Comment for "40 irs quarterly payment coupon"