40 coupon rate semi annual

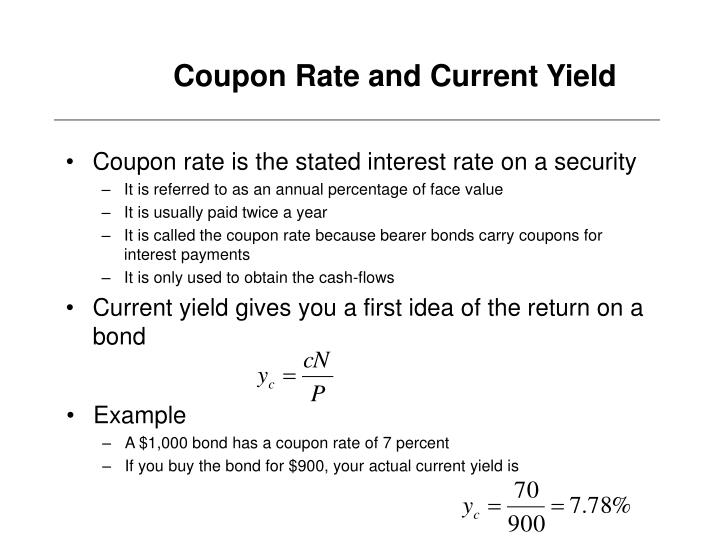

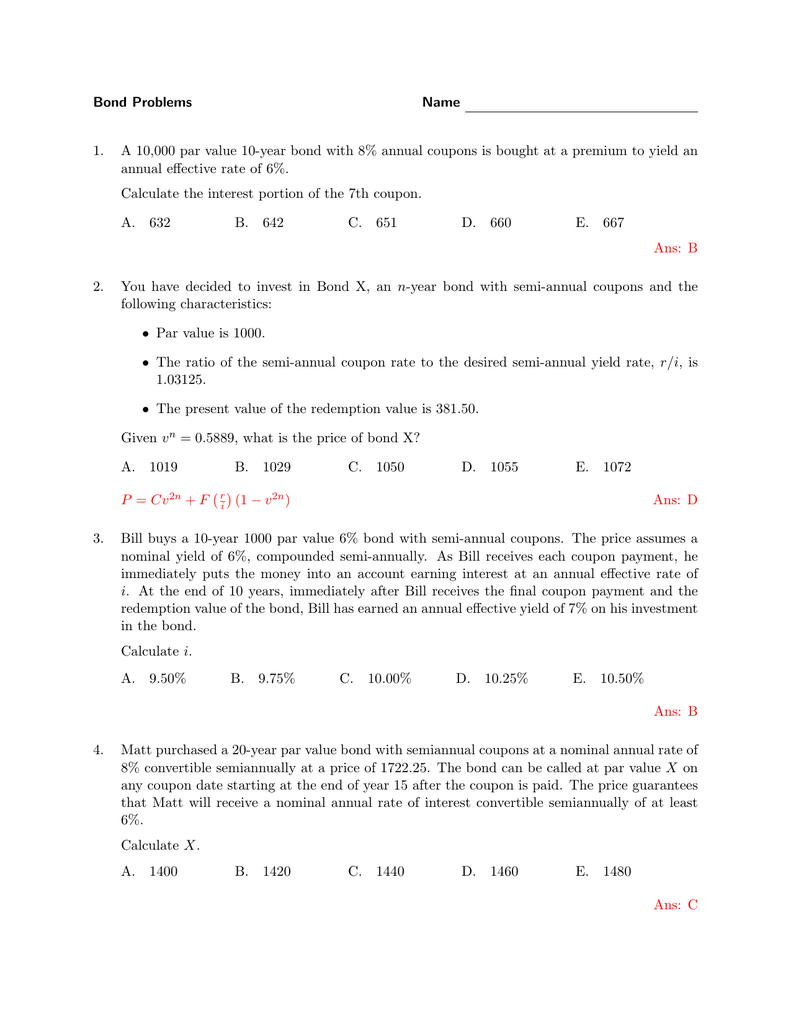

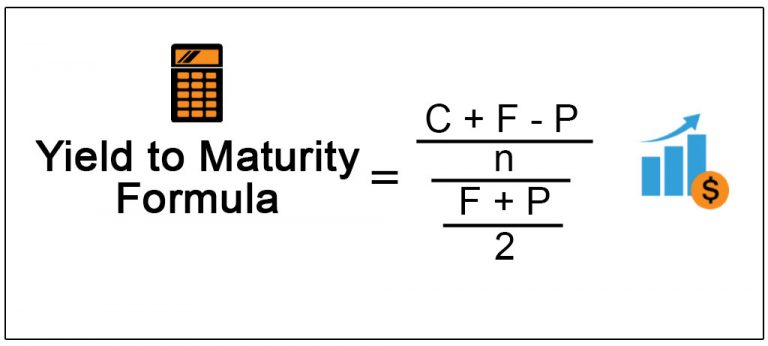

Bond Yield to Maturity (YTM) Calculator - DQYDJ This makes calculating the yield to maturity of a zero coupon bond straight-forward: Let's take the following bond as an example: Current Price: $600. Par Value: $1000. Years to Maturity: 3. Annual Coupon Rate: 0%. Coupon Frequency: 0x a Year. Price =. (Present Value / Face Value) ^ (1/n) - 1 =. How to Calculate the Price of a Bond With Semiannual Coupon Interest ... Therefore, you would use 5 percent as your required rate of return. Converting Payment Periods Because semiannual coupon payments are paid twice per year, your required rate of return, mathematically speaking, must be cut in half. Therefore, the example's required rate of return would be 2.5 percent per semiannual period.

Coupon Rate: Formula and Bond Nominal Yield Calculator Coupon Rate = 6% Annual Coupon = $100,000 x 6% = $6,000 Since most bonds pay interest semi-annually, the bondholder receives two separate coupon payments of $3k each year for as long as the bond is still outstanding. Number of Periods (N) = 2 Coupon Payment = $6,000 / 2 = $3,000 Bond Coupon Rate Calculation Steps

Coupon rate semi annual

DOCX Chapter 4 Coupon Rate - Annual interest payment as a percent of the face value. Note that most bonds make their interest payments semiannually. Example: 10 year $10,000 U.S. Treasury Note with 7% coupon rate. New Issue. Maturity - Ten years from today. Face Value - $10,000. Coupon Rate - 7% of $10,000 = $700 per year = $350 every six months. › knowledge-center › how-to-calculateHow to Calculate Semi-Annual Bond Yield | The Motley Fool Nov 25, 2016 · For instance, in the example above, an investor who bought the bond for $900 would get $10 semi-annual interest payments for five years, but would then get $1,000 at maturity -- adding another ... Semi-annual rate - ACT Wiki = 2% per six month period. A semi-annual rate is an example of a nominal annual rate. The semi-annual rate is not to be confused with the periodic rate per 6 months, which in this case is 2%. Nor should it be confused with the related annual effective rate, which in this case would be: = 1.02 2 - 1 = 4.04%. See also Effective annual rate

Coupon rate semi annual. Coupon Rate - Meaning, Calculation and Importance The coupon payments are semi-annual, and the semi-annual payments are INR 50 each. To calculate the couponrate for Company A's bond, we need to know the total annual interest payments. Total Annual Interest Payments = 50 + 50 = 100 Coupon Rate = 100 / 500 * 100 = 20% Therefore, the coupon rate for the Company A bond is 20%. Coupon Bond - Guide, Examples, How Coupon Bonds Work The issuer of the bond agrees to make annual or semi-annual interest payments equal to the coupon rate to investors. These payments are made until the bond's maturity. Let's imagine that Apple Inc. issued a new four-year bond with a face value of $100 and an annual coupon rate of 5% of the bond's face value. Semiannual coupon and annual coupon | Forum | Bionic Turtle So the rate is 5% per semiannual period which is used to pay coupon at end of each half year. so that for a bond with face value 100 with 10% semiannual couponsmeans that coupons are paid semiannually (at end of each half year) at 10/2%=5% which is (5/100)*100=5 , so the semiannual coupon is 5% because the rate 10% is compounded semiannually. › savings › apy-to-aprConvert APY to Equivalent APR: Annual Percentage Rate ... First enter the APY in percent. Some banks also refer to this as the effective annual rate (EAR). Next enter how frequently interest compounds each year. Common compounding frequencies appear in the drop down. daily = 365, weekly = 52, biweekly = 26, semimonthly = 24, monthly = 12, bimonthly = 6, quarterly = 4, semiannual = 2, annual = 1

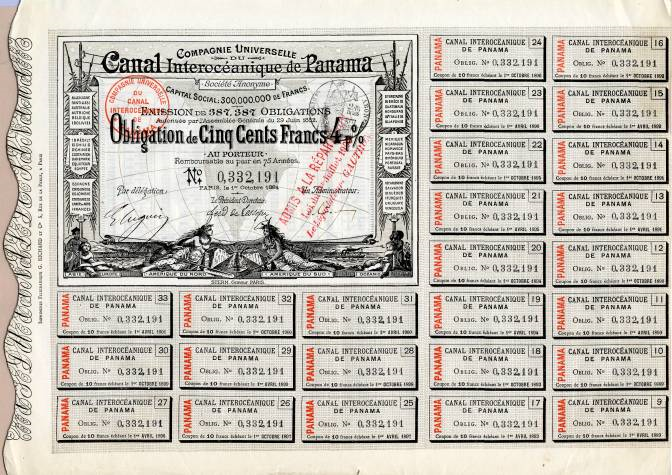

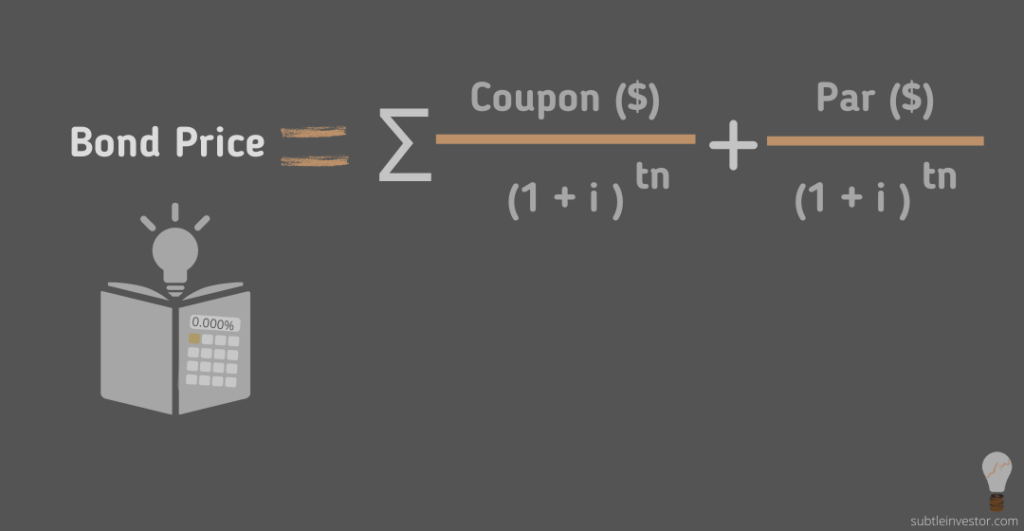

Bond Price Calculator Coupon rate is the annual rate of return the bond generates expressed as a percentage from the bond's par value. Coupon rate compounding frequency that can be Annually, Semi-annually, Quarterly si Monthly. Market interest rate represents the return rate similar bonds sold on the market can generate. This figure is used to see whether the bond ... Buying a $1,000 Bond With a Coupon of 10% - Investopedia Most bonds pay interest semi-annually, which means bondholders receive two payments each year. 1 So with a $1,000 face value bond that has a 10% semi-annual coupon, you would receive $50 (5% x... to APY Calculator | Convert Annual Percentage Rate (APR ... Convert Annual Percentage Rate (APR) to Annual Percentage Yield (APY) ... Semi-Annually 4.04%. Monthly 4.07%. Weekly 4.08%. Daily 4.08%. ️ Like APRtoAPY.com? Solved If a bond's coupon rate is 5%, what is the | Chegg.com If a bond's coupon rate is 5%, what is the semi-annual coupon payment? Question : If a bond's coupon rate is 5%, what is the semi-annual coupon payment? This problem has been solved!

Coupon Rate Formula | Calculator (Excel Template) - EDUCBA Coupon Rate is calculated using the formula given below Coupon Rate = (Annual Coupon (or Interest) Payment / Face Value of Bond) * 100 For Secured NCDs Coupon Rate = (89 / 1000) * 100 Coupon Rate= 8.9% For Unsecured NCDs Coupon Rate = (91 / 1000) * 100 Coupon Rate= 9.1% › Calculate-Annual-Interest-on-Bonds3 Ways to Calculate Annual Interest on Bonds - wikiHow Mar 29, 2019 · To calculate the annual interest, you need to know the coupon rate and the price of the bond. For example, Company QRS issues 5-year, $500,000, 10 percent bonds, with interest paid semi-annually. The market interest rate is 10 percent, so the bond is issued at par. Coupon Rate Definition For example, a bond issued with a face value of $1,000 that pays a $25 coupon semiannually has a coupon rate of 5%. All else held equal, bonds with higher coupon rates are more desirable for... azcalculator.com › calc › coupon-rateCoupon Rate Calculator | Calculate Coupon Rate - AZCalculator Jun 27, 2021 · Online coupon rate calculation. Use this simple finance coupon rate calculator to calculate coupon rate.

How To Calculate Interest Compounded Semiannually (With ... - Indeed The formula you would use to calculate the total interest if it is compounded is P[(1+i)^n-1]. Here are the steps to solving the compound interest formula: Add the nominal interest rate in decimal form to 1. The first order of operations is parentheses, and you start with the innermost one.

Zero Coupon Bond Calculator 【Yield & Formula】 - Nerd Counter Suppose you have a bond and its face value is $1000 with the present price of $900, and the coupon rate is 2%. Its maturity period is also five years. So, when we calculate the semi-annual bond payment, first of all, we have to get 2% of the face value of $1,000, which is $20, and after that, we have to divide it by two.

interest rate - Are coupons all semi-annual? - Economics Stack Exchange For example, if the coupon rate was 8% and the interest rate was 4%. On a $100 priced bond, I would get 8 dollars in the first year, which is 8% returns, as opposed to 5% returns on the interest rate.

Bond Price Calculator - Brandon Renfro, Ph.D. A bond's coupon is the interest payment you receive. Use the simple annual coupon payment in the calculator. If your bond has a face, or maturity, value of $1,000 and a coupon rate of 6% then input $60 in the coupon field. Compounding Frequency. For most bonds, this is semi-annual to coincide with the fact that you receive two annual coupon ...

› finance › coupon-rateCoupon Rate Calculator | Bond Coupon Jan 12, 2022 · As this is a semi-annual coupon bond, our annual coupon rate calculator uses coupon frequency of 2. And the annual coupon payment for Bond A is: $25 * 2 = $50. Calculate the coupon rate; The last step is to calculate the coupon rate. You can find it by dividing the annual coupon payment by the face value: coupon rate = annual coupon payment ...

vindeep.com › Calculators › RateConverterCalcInterest Rate Converter | Convert annual to monthly, semi ... You can also use this tool to compare two or more interest rates having different interest payment frequencies. For example, if you need to compare an interest rate of 12% p.a., payable monthly with an interest rate of 12.50% p.a., payable annually to find which one is expensive in terms of effective cost, convert the former into annual one or the latter into monthly one using this tool - to ...

Macaulay Duration - Overview, How To Calculate, Factors The Macaulay duration of a bond can be impacted by the bond's coupon rate Coupon Rate A coupon rate is the amount of annual interest income paid to a bondholder, based on the face value of ... and the semi-annual interest is 2.5%. Therefore, the Modified duration of the bond is 1.868 (1.915 / 1.025). It means for each percentage increase ...

1. Assume that a bond with semi-annual coupon payment | Chegg.com Finance. Finance questions and answers. 1. Assume that a bond with semi-annual coupon payment is outstanding. An increase in market interest rates will: increase the coupon rate of the bond. decrease the coupon rate of the bond. increase the market price of the bond. decrease the market price of the bond. not affect the market price of the bond.

Post a Comment for "40 coupon rate semi annual"